Solana’s DeFi, NFTs, and Institutional Adoption Drove 213% Revenue Growth in Q4 2024

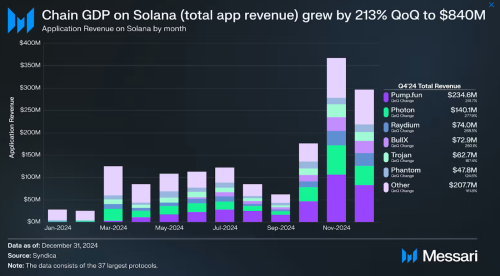

Solana (SOL) marked Q4 2024 as one of its most explosive growth periods yet, with total revenue jumping 213% from $268 million to $840 million, according to the “State of Solana Q4 2024” report released by Messari on Feb. 5.

Applications like Pump.fun ($235 million revenue) and Photon ($140 million revenue) led the charge, driven by speculative trading in meme coins and AI-themed assets.

Solana DApps saw record fees and revenue in Q4 amid resurgence of meme coins. Source: Messari

-solana-s-growth”>DEX Boom Fuels Solana’s Growth

According to the report, total value locked (TVL) on Solana soared by 64% quarter-over-quarter (QoQ), reaching $8.6 billion and surpassing Tron (TRX) to claim the second spot in decentralized finance (DeFi) rankings.

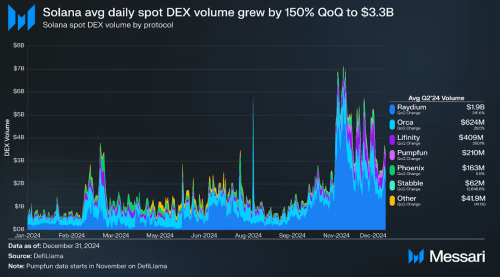

Key drivers of this surge included the growth of decentralized exchanges (DEXs) like Raydium (+242%), Lifinity (+360%), and Jupiter Perps (+73%).

Solana spot DEX volume by protocol in 2024. Source: Messari

The meme coin frenzy and the rise of AI-related tokens like FARTCOIN and AI16z further fueled trading volumes, with DEX volumes averaging $3.3 billion daily, a 150% QoQ increase.

SOL’s market cap rose 27% QoQ to $91 billion, peaking at $120 billion in November. The network’s real economic value (REV) increased by 211% QoQ to $819 million, driven by heightened transaction activity and maximal extractable value (MEV) tips.

Network activity saw a 171% QoQ rise in daily fee payers, reflecting growing user engagement.

Key infrastructure upgrades in Q4 also included the release of Agave V2.0, with over 90% of the network adopting the new client, and the development of the Firedancer client, promising significant scalability improvements.

Liquid staking on Solana also saw a 33% QoQ rise.

Tensor Takes the Lead in Solana NFT Marketplaces

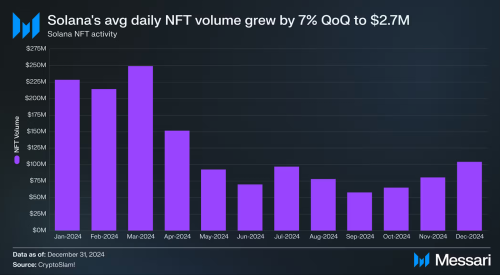

While average daily non-fungible token (NFT) volume on Solana grew by a modest 7% in Q4, Solaba-based NFT marketplaces such as Tensor and Magic Eden continued to dominate.

Tensor took the majority of share in Q4, with $103 million in volume, a 14% QoQ increase. Magic Eden’s volume decreased by 28% QoQ to $68 million.

Solana NFT volume in 2024. Source: Messari

The Seeker phone and Time.fun’s migration showcased Solana’s expanding consumer reach. Additionally, creator-focused platforms like Calaxy and Sanctum’s Creator Coins highlighted the network’s support for digital creators.

Solana ETF Race Heats Up

Institutional adoption of Solana is also growing rapidly.

Thailand’s oldest commercial bank, Siam Commercial Bank, will use Solana to offer stablecoin cross-border payment and remittance services.

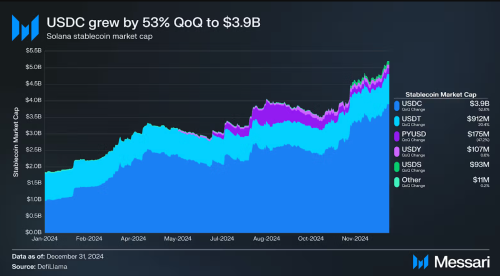

In general, the stablecoin market cap on Solana grew 36% QoQ to $5.1 billion, ranking it 5th among networks. USD Coin (USDC) remained the dominant stablecoin on Solana.

Solana stablecoin market cap in 2024. Source: Messari

Despite regulatory hurdles, the outlook for a Solana-based exchange traded fund (ETF) has also brightened considerably.

On Jan. 29, Cboe BZX Exchange reignited the race for Solana-based ETFs by refiling a new batch of applications on behalf of four major investment firms. The exchange submitted fresh 19b-4 filings for the Canary Solana Trust, Bitwise Solana ETF, 21Shares Core Solana ETF, and VanEck Solana Trust.

These filings have prompted the Securities and Exchange Commission (SEC) to restart its review process for spot Solana investment products, following the withdrawal of previous applications at the SEC’s request last year.

If approved, these Solana ETFs would allow traditional investors to gain exposure to Solana without directly holding the cryptocurrency, potentially broadening access to the digital asset market and attracting significant institutional capital.

Source: cryptonews.com