Ether (ETH) Price Nears Mass Liquidation Level

One position worth $126 million was just 4% away from liquidation.

Updated March 4, 2025, 15:55 UTC Published March 4, 2025, 14:43 UTC

What you need to know:

- On Tuesday, MakerDAO's $126 million position was liquidated for just $80.

- Three positions worth $349 million could be liquidated at ETH prices between $1,796 and $1,929.

- ETH has fully recouped Sunday's gains, falling 22% over the past 48 hours.

An ether (ETH) position worth more than $126 million was just 4% away from being liquidated as cryptocurrency prices slumped on Tuesday.

ETH has now recovered more than all of Sunday's gains, losing 22% of its value in the last 48 hours to trade at $2,080.

A successful run to $2,000 helped protect Ethereum's decentralized finance (DeFi) ecosystem from a series of liquidations on collateralized debt obligation platform MakerDAO.

The first level of liquidation is $1929, with two more positions available for liquidation at $1844 and $1796. The combined value of all three positions is $349 million.

Price action often gravitates toward liquidation levels as trading firms target areas of supply. When a liquidation occurs on MakerDAO, the ETH used as collateral will be sold or auctioned, with a portion of the fees going to the protocol. In the case of MakerDAO, ETH is often bought at a discount and then resold on the broader marketplace for a profit, which can cause additional price drops.

Liquidations in DeFi are more efficient than futures because they are linked to spot assets rather than derivatives, which have a higher level of liquidity due to significant leverage.

In this case, it is advantageous for trading firms to focus on these levels, as liquidation will create short-term volatility and may cause a cascade, where one liquidated position forces several others to liquidate.

Once the cascade is complete and buyers have absorbed the new supply, the price will usually rise again, which may prompt the trader who liquidated his position to buy back his long position.

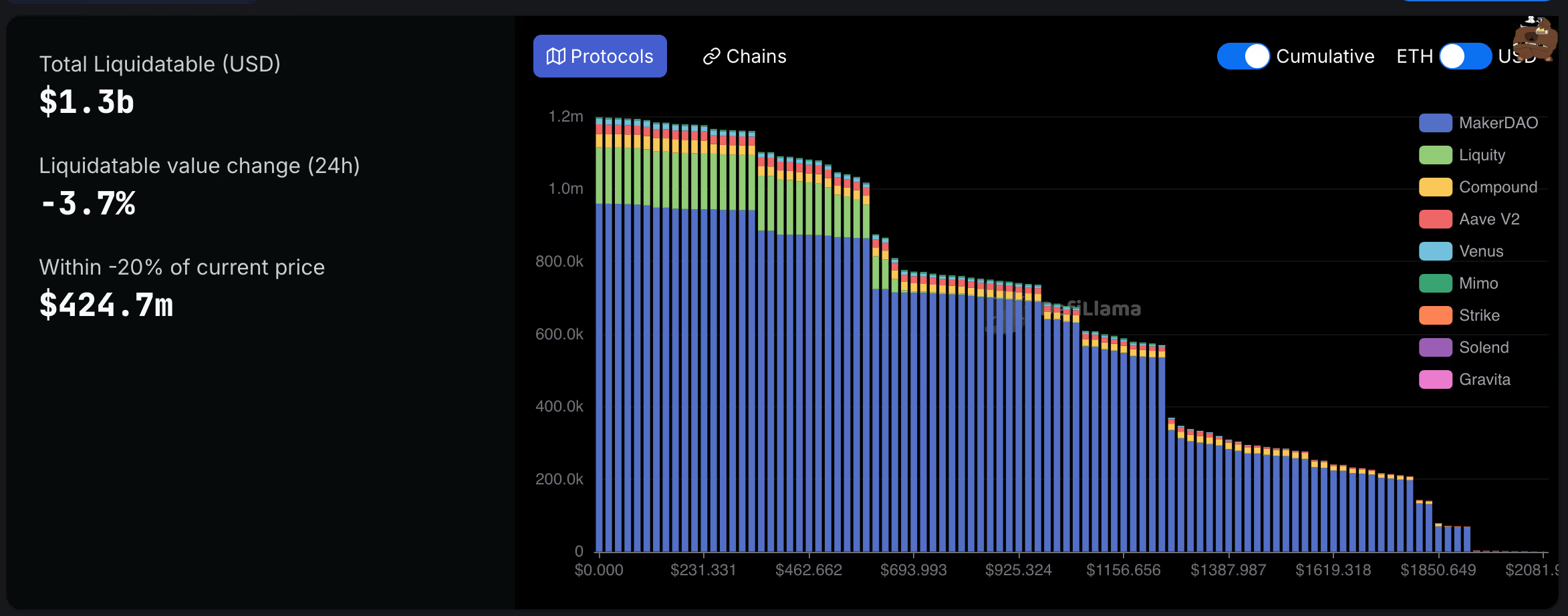

According to DefiLlama, $1.3 billion worth of Ether could be liquidated, with $427 million of that within 20% of the current price.

ETH has lagged Bitcoin (BTC) during the recent bull market, falling to a ratio of 0.0235 from previous cycle highs of 0.156 and 0.088. This is partly due to institutional inflows into various BTC spot ETFs, as well as the rise of other blockchains like Solana and Base, which have gained market share.