HIVE Digital Plans 4X Hashrate Growth, $100M Revenue From HPC – Will Things Take Off in 2025?

HIVE Digital aims to quadruple its hashrate by September 2025, which could put the company in the top 10 public Bitcoin miners. It also has a $100 million ARR target for HPC. Is this small-cap miner a missed opportunity?

HIVE Digital Targets HPC Revenue Growth and Expansion

This guest post is from Bitcoinminingstock.io, a one-stop source for all things Bitcoin mining stocks, education, and industry insights. Originally published on February 27, 2025, Bitcoinminingstock.io is authored by Cindy Feng.

The spotlight has long been on the largest companies in the Bitcoin mining space, but what about the smaller players? This year, I’m starting a new series dedicated to the small-cap miners that often fly under the radar. Some of these companies could be future leaders, while others may be struggling. Understanding their current position can help identify hidden opportunities or learn valuable lessons. In this series, I’ll look at their business fundamentals, financials, strategic focus, and market positioning, giving you a clear and objective view of their strengths, weaknesses, and investment potential.

First up : Hive Digital Technologies , a multi-functional Bitcoin miner that handles both mining and high-performance computing (HPC).

Company overview

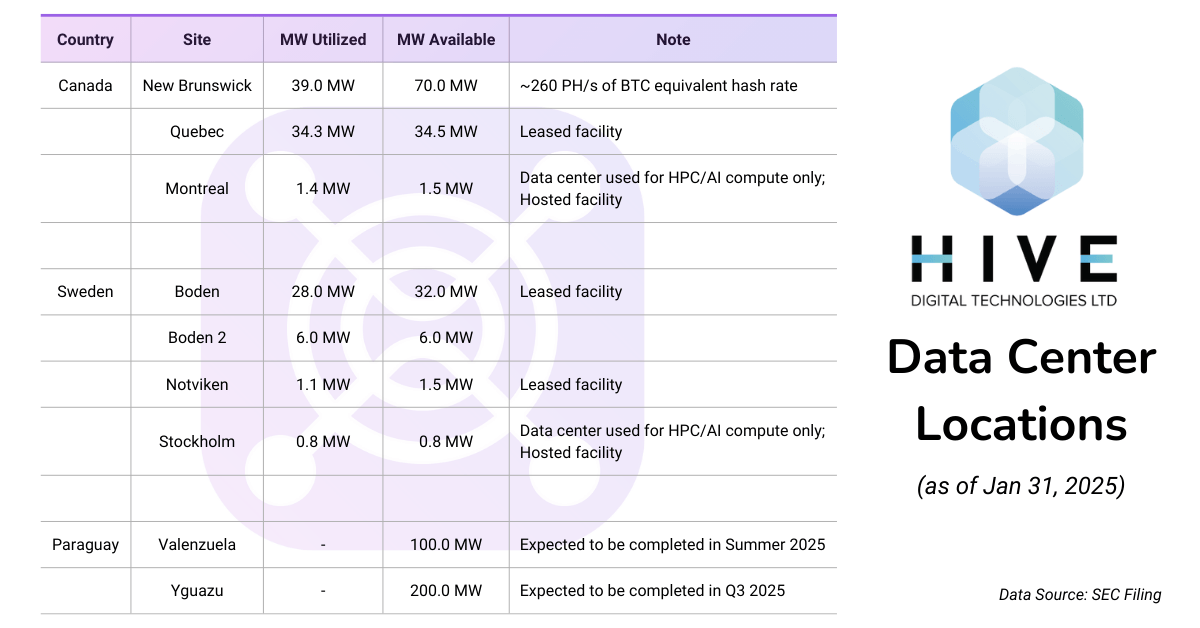

Hive Digital Technologies (TSX.V: HIVE; NASDAQ: HIVE) is a publicly traded data center operator focused on digital asset mining and HPC. In December 2024, the company announced that it would be moving its headquarters to San Antonio, Texas, United States. It has data centers in various locations, including Canada, Sweden, and soon Paraguay . The company is known for its commitment to green energy, primarily using hydroelectric and geothermal sources for its operations.

Business structure

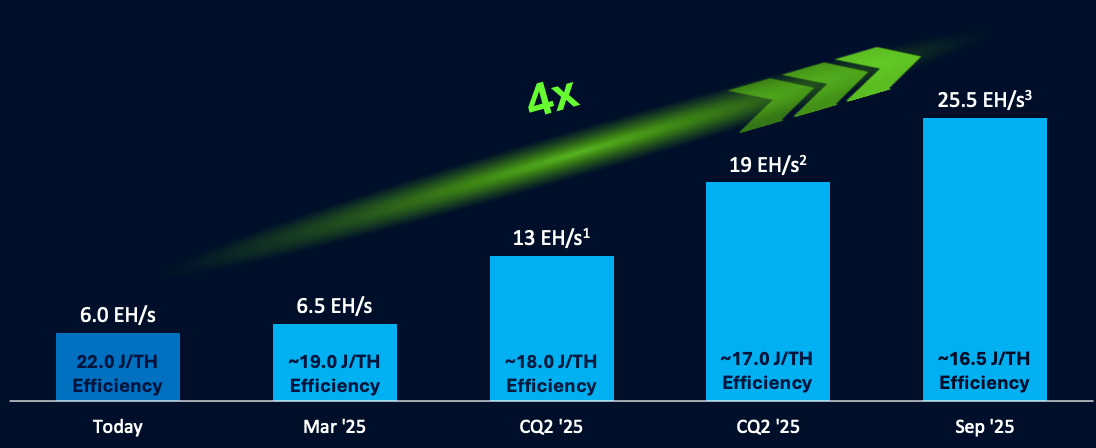

- Mining Operations : The company operates a total hashing power of 6 EH/s (as of January 31, 2025) with an ambitious expansion plan to reach 25 EH/s by September 2025.

HIVE plans to quadruple its hashrate by September 2025 (screenshot from company presentation)

HIVE plans to quadruple its hashrate by September 2025 (screenshot from company presentation)

- HPC and AI Computing : HIVE was one of the first public miners to move into HPC, leveraging its expertise in GPU-powered Ethereum mining. Back in 2023, the company reported $1.61 million in revenue from HPC hosting. Hive currently continues to use its existing data centers in Montreal, Canada and Stockholm, Sweden to provide HPC services. Additionally, the company plans to offer GPU server rentals through marketplace aggregators and explore new cloud offerings.

Financial performance: revenue decline and profitability growth

Notes: HIVE provides financial comparisons across periods in its latest report. The income statement follows a standard year-over-year comparison (December 31, 2024 vs. December 31, 2023), while the balance sheet is compared to March 31, 2024. Meanwhile, the cash flow statement uses a nine-month comparison (December 31, 2024 vs. December 31, 2023). To ensure consistency and simplify analysis, this report primarily focuses on year-over-year comparisons where possible.

In the third fiscal quarter of 2025 (October 1 – December 31, 2024), HIVE Digital Technologies recorded a year-over-year decline in revenue. The main reason for this decline was the reduction in BTC production due to the Bitcoin halving in April 2024. However, the company showed a significant turnaround in net income ($1.27 million vs. -$6.95 million), which was driven by the rise in the Bitcoin price, the increase in the HPC business, and cost optimization.

Income Statement Key Figures

- Revenue: $29.2M (-6.5% YoY) vs. $31.3M in Q3 2024. This decline was due to a decline in Bitcoin mining revenue (-11.3% YoY) due to a drop in production (322 BTC vs. 830 BTC in Q3 2024) following the Bitcoin halving in April 2024. However, the rise in Bitcoin price and a significant increase in HPC revenue (+123.6% YoY, reaching $2.5M) helped offset this.

Source: cryptonews.net