CleanSpark Q1 FY25 Earnings Analysis: Strong Execution, But Shares Underperform

CleanSpark delivered impressive financial results for the quarter, but its market metrics did not show similar growth. This analysis examines key financial data, operational metrics, and strategic directions to provide a complete picture.

CleanSpark Review: Efficient Execution Amid Market Uncertainty

This guest post is from Bitcoinminingstock.io, a comprehensive resource for bitcoin mining stock information, educational tools, and industry insights. Originally published on February 20, 2025, by Cindy Feng of Bitcoinminingstock.io.

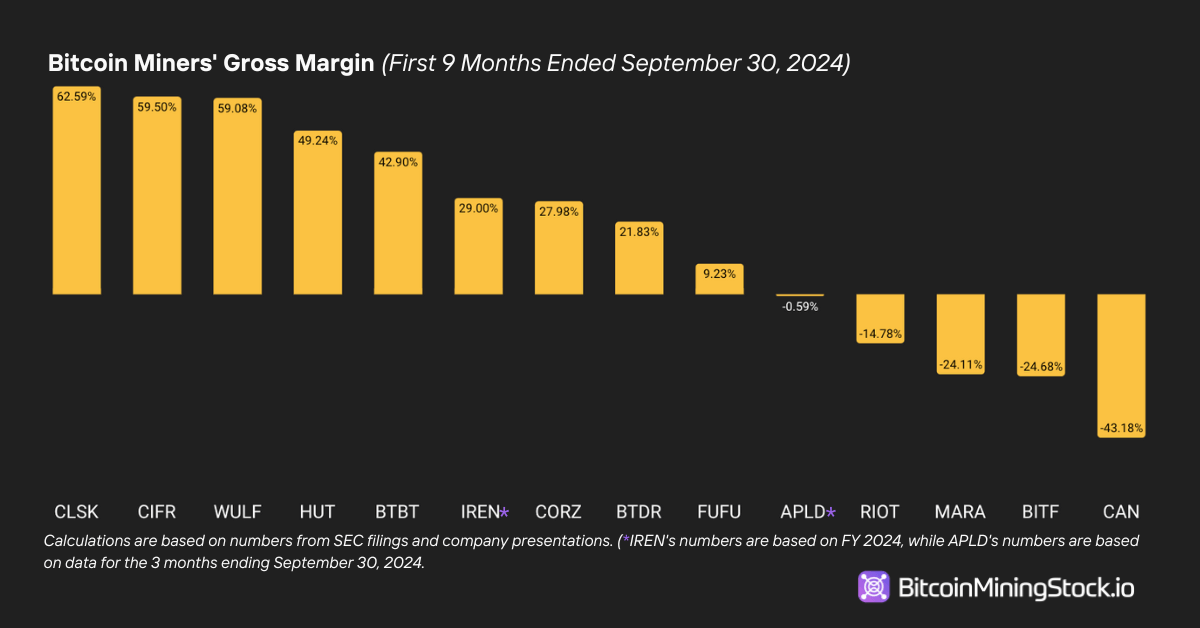

When I prepared my annual Bitcoin mining report in December 2024, CleanSpark stood out in several key metrics, including gross profit , hashrate expansion, M&A, and hardware upgrades . At that point, I believed the company was poised for a strong year ahead if the price of Bitcoin continued to rise.

Screenshot from the annual report (co-authored with Niko Smid of Digital Mining Solutions)

Screenshot from the annual report (co-authored with Niko Smid of Digital Mining Solutions)

However, after CleanSpark's Q1 2025 financial report, released on February 6, 2025, the company's stock remained flat and even declined . This market reaction raised a number of questions for me: What numbers surprised investors? Did the company give any guidance that made investors nervous? Let's take a closer look at the numbers and analyze what might be going on.

Financial results: revenue and profitability increased significantly

CleanSpark had a strong first fiscal quarter of 2025 (October 1 to December 31, 2024) , showing solid revenue growth and strong profitability driven by the rising price of Bitcoin and improved operational efficiency.

Income Statement Key Figures:

- Revenue : $162.3 million (+120% YoY) compared to $73.8 million in Q1 2024. This was primarily driven by the rise in the price of Bitcoin , which was partially offset by a decrease in Bitcoin mining volume due to the halving in April 2024.

- Net income : $246.8 million (+854% year-on-year) vs. $25.9 million in Q1 2024, primarily due to the revaluation of Bitcoin.

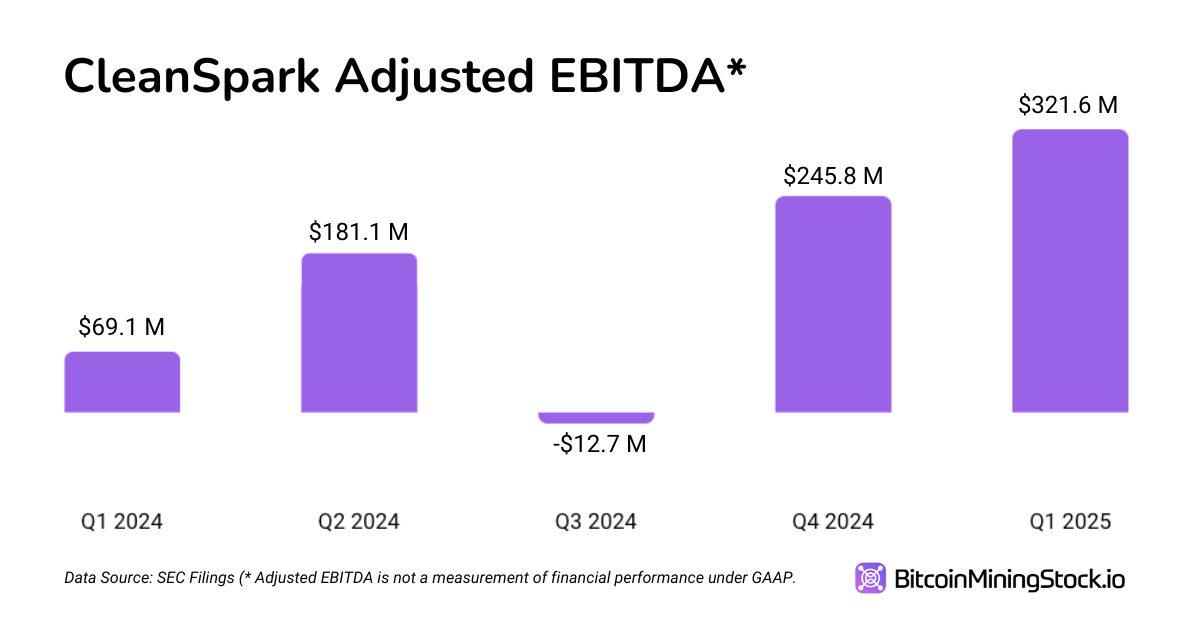

- Adjusted EBITDA : $321.6 million, a new record, up from $69.1 million. (*This figure includes a fair value gain of $218.2 million)

- Gross margin : 57%, down slightly from 60% a year earlier due to higher operating costs (particularly electricity costs and expansion of mining infrastructure).

- Bitcoin Mining : 1945 BTC, which is slightly less than 2020 BTC in Q1 2024 due to the Bitcoin halving in April 2024.

Key Balance Sheet Indicators

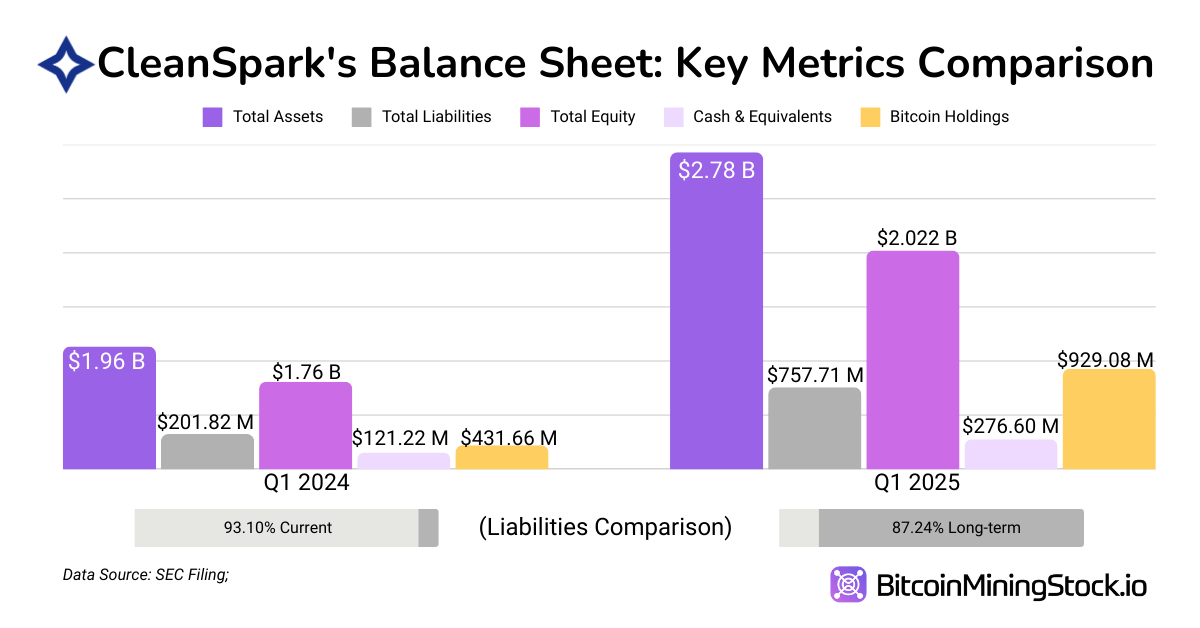

- Total assets : $2.78 billion (+41.6% YoY) vs. $1.96 billion in Q1 2024. This is mainly due to increased Bitcoin reserves, data center expansion, and new mining infrastructure.

- Total current liabilities: $96.7 million, down from $187.9 million, primarily due to loan repayments ($52.2 million paid).

- Long-term liabilities: $641.4 million (up from $7.2 million), primarily due to the issuance of new convertible bonds.

- Equity : $2.02 billion (+14.8% year-on-year) compared to $1.76 billion in Q1 2024.

- D/E ratio: 0.32 (up from 0.08), indicating that CleanSpark has significantly increased its leverage over the past year by taking on more debt to fund growth.

Key Cash Flow Indicators

- Operating cash flow: $119.5 million in net cash used in operating activities.

- Investing cash flow: amounted to US$255.9 million (including US$126.9 million for new mining operations and US$57.4 million for core

Source: cryptonews.net