Cryptocurrency VC Dragonfly Estimates Geo-Blocked Airdops Value for US Token Holders

US Residents Lost Up to $2.6 Billion in Potential Revenue Due to Geo-Blocked Distributions

According to a report by Dragonfly, the US government lost out on about $1.4 billion in potential tax revenue.

Author: Ian Ellison | Edited by Sheldon Reback Updated March 11, 2025, 16:01 UTC Published March 11, 2025, 13:00 UTC

What you need to know:

- SEC enforcement action has forced crypto projects to restrict US users' access to airdrops.

- Dragonfly data shows that airdrops have raised over $7.16 billion across 11 projects.

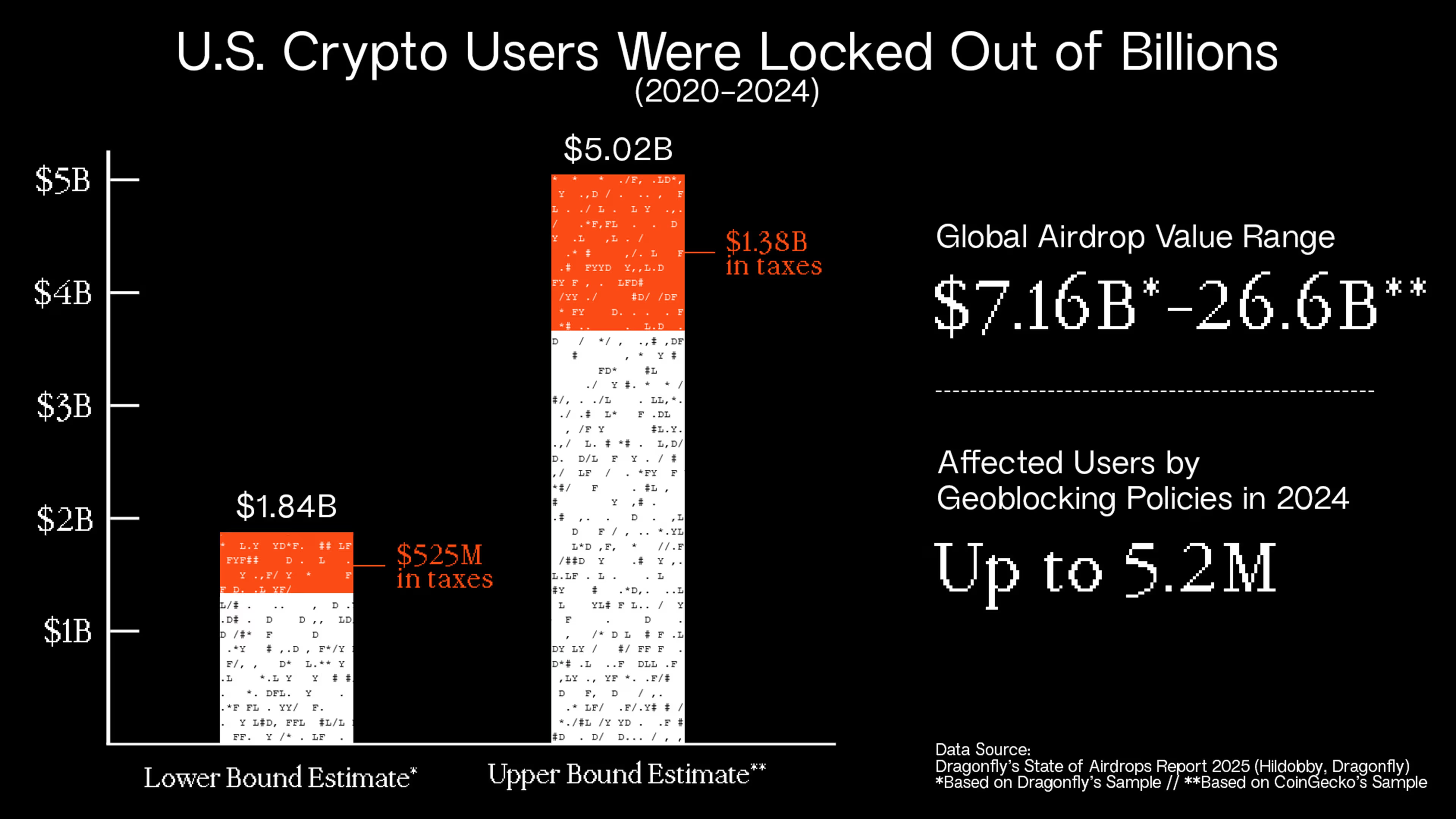

- Between 2020 and 2024, US users lost an estimated $2.64 billion in potential revenue due to geoblocking.

According to venture capital firm Dragonfly, the strict regulation of cryptocurrencies, which prevented Americans from taking advantage of duty-free trading (a form of rewarding users through the distribution of free tokens), resulted in the loss of $2.6 billion in potential income for U.S. residents and $1.4 billion in lost tax revenue for the government.

In a report released Tuesday, the digital asset firm shared a series of statistics based on an analysis of 11 major airdrops that have generated more than $7.16 billion since 2020. The list includes companies like 1inch, EigenLayer, Arbitrum, Athena, Optimism, and LayerZero. The average median payout per eligible address participating in these airdrops was $4,562.

“We realized that there was a real need for data that could clearly demonstrate the impact of forced regulation and how those policies affected individuals, the broader economy, and the U.S. government,” Jessica Furr, Dragonfly’s deputy general counsel, said in an interview. “So we decided to focus on airdrops as a specific category of cryptocurrency use to understand how current regulations may have led to certain negative outcomes.”

The report estimated that between 2020 and 2024, US users lost between $1.84 billion and $2.64 billion in potential revenue due to geo-blocking, a method that allows crypto projects to avoid regulatory scrutiny like the Securities and Exchange Commission (SEC) by isolating IP addresses in the US.

The losses could be even more significant. Using a larger sample of 21 geo-blocked airdrops analyzed by CoinGecko, Dragonfly found that the total potential loss of revenue for U.S. residents could have been between $3.49 billion and $5.02 billion between 2020 and 2024.

Years of regulatory uncertainty in the U.S. have had a negative impact on innovation in the cryptocurrency space, forcing startups to move overseas while larger companies have faced subpoenas and legal battles with regulators.

In addition to blockchain developers, venture capital firms like Union Square Ventures and Andreessen Horowitz have also come under fire from the SEC for investing in platforms like Uniswap, which Dragonfly's report calls the last major cryptocurrency airdrop platform available in the U.S.

Dragonfly isn't the only venture capital firm to take note of the US geo-blocking issue: New York-based Variant Fund has also produced a report that looks at how crypto companies have no choice but to resort to a blunt instrument – simply excluding all US users for fear of possible regulatory action.

“If the rules are unclear about

Источник