Ether Whale Averts $340M Liquidation With Last-Minute Deposit Series

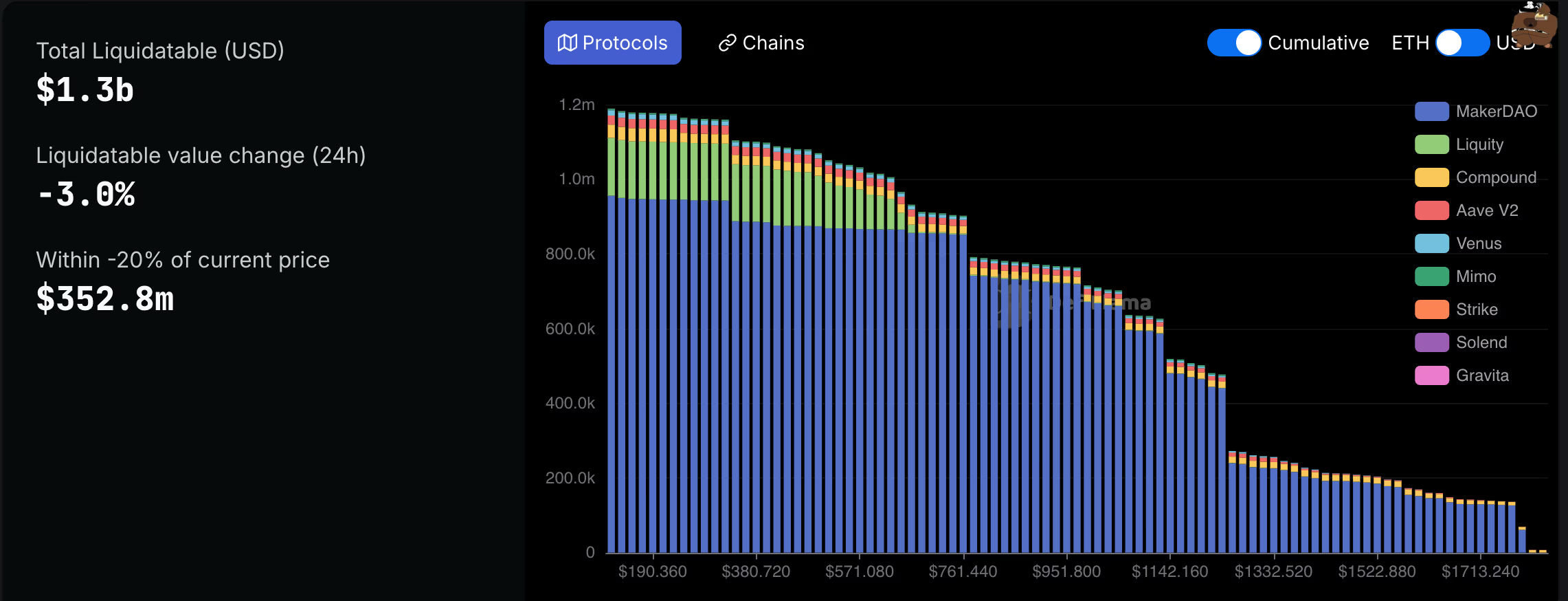

Ethereum continues to be a threat of multiple on-chain liquidations.

Oliver Knight | Edited by Steven Alpher Updated March 11, 2025, 16:08 UTC Published March 11, 2025, 13:50 UTC

Key points:

- On Monday, the price of Ether dropped to $1,788, almost triggering a chain of liquidations on the network.

- One wallet prevented liquidation by adding 2,000 ETH as collateral and returning $1.5 million in DAI stablecoins.

- Another wallet, believed to belong to the Ethereum Foundation, contributed 30,098 ETH ($56.08 million) to reduce the liquidation price of its position.

An Ethereum user prevented a $360 million MakerDAO cascading liquidation on Tuesday by adding collateral at the last minute as ETH's value plunged.

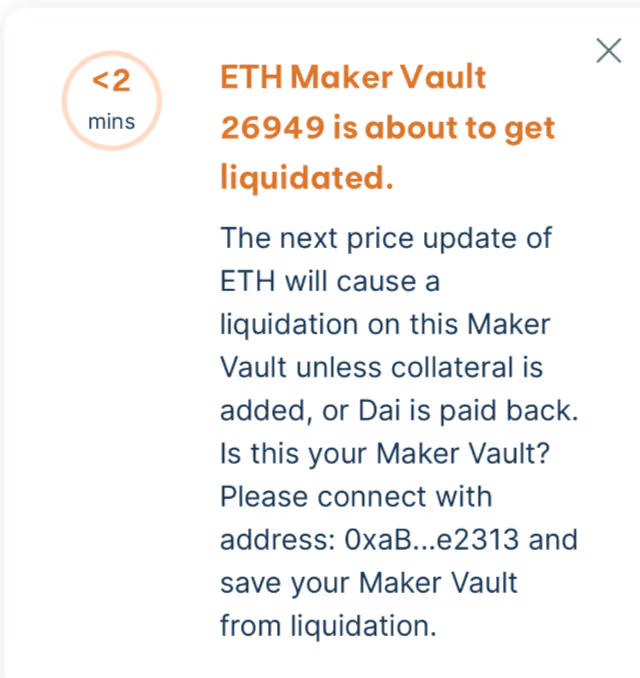

One of the positions had a liquidation price of $1,928, which was caused by a market drop during US trading hours. ETH was less than two minutes away from being liquidated and sold on the MakerDAO auction until the wallet owner deposited 2,000 ETH from Bitfinex as additional collateral. He also paid $1.5 million in DAI stablecoins.

The wallet in question surprised some by maintaining its position, as it had previously remained inactive since November.

This particular position is not out of danger yet; it could be liquidated if ETH drops to $1,781 or the owner adds more collateral. Ether is currently trading at $1,928, having recovered from Monday’s low of $1,788.

Another wallet, believed to belong to the Ethereum Foundation according to the X Lookonchain account, contributed 30,098 ETH ($56.08 million) to reduce the liquidation price of its position to $1,127.

While liquidations worth hundreds of millions of dollars are fairly common in derivatives markets, decentralized finance (DeFi) protocols like MakerDAO only use spot assets. This means that if a liquidation occurs, DeFi liquidity cannot cope with the excess supply of spot assets. This does not happen on derivatives exchanges, where leverage typically drives higher volume and liquidity.

In this case, one of the nine-digit liquidations on MarkerDAO would likely cause the price of ETH to fall, liquidating another vulnerable position in its path.

By

Источник