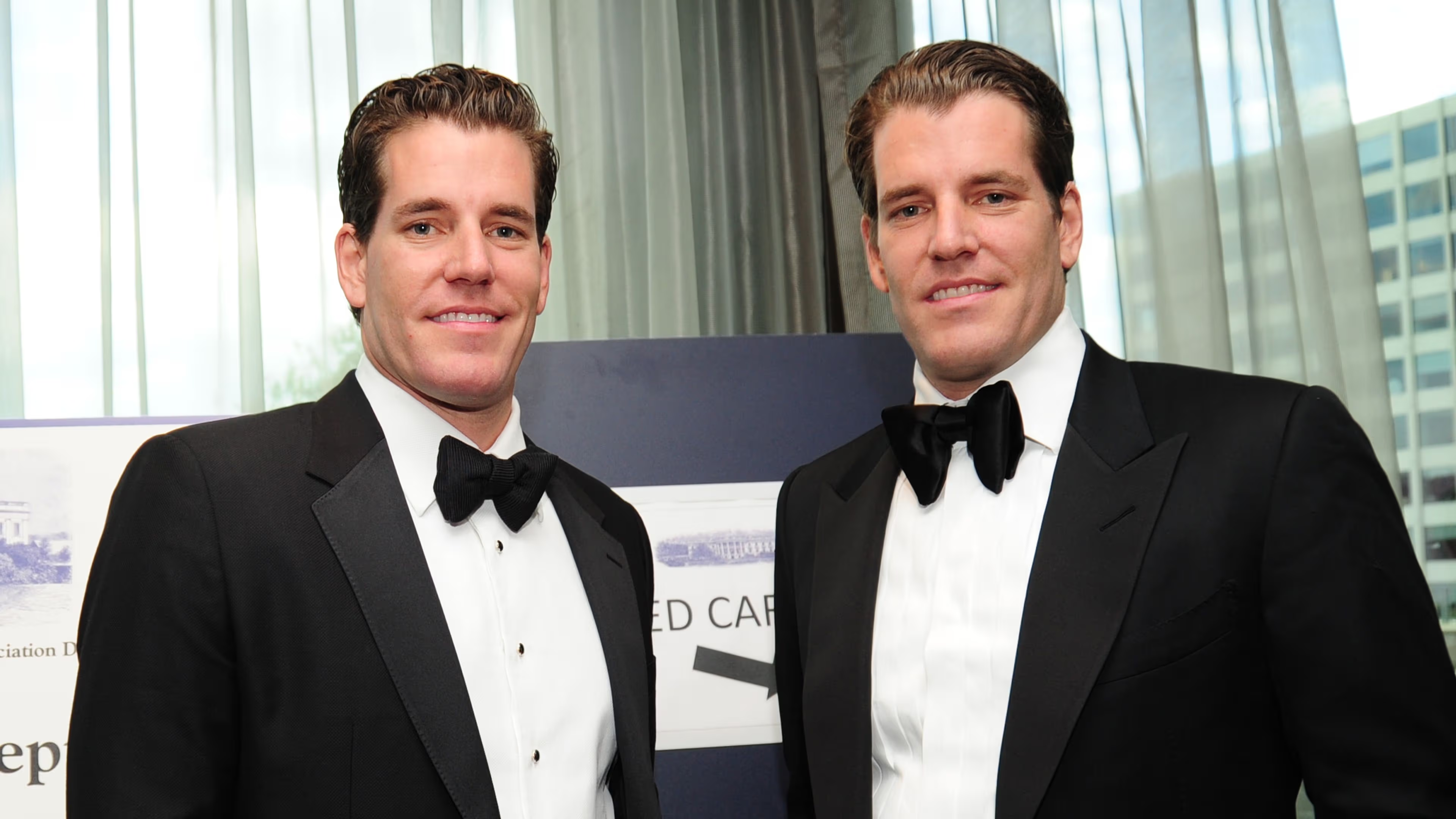

Gemini, Backed by Billionaire Winklevoss Twins, Confidentially Files for U.S. IPO: Bloomberg

Gemini, a company backed by the billionaire Winklevoss twins, has quietly filed for an initial public offering (IPO) in the U.S., Bloomberg reports.

The report said Gemini had tapped Goldman Sachs and Citigroup for a potential IPO.

Author: Aoyon Ashraf Updated March 7, 2025, 23:32 UTC Published March 7, 2025, 23:29 UTC

What you need to know:

- Gemini, the crypto exchange founded by the Winklevoss twins, has secretly filed for an IPO in a bid that includes Goldman Sachs and Citigroup.

- The potential IPO follows the Securities and Exchange Commission's decision to end its investigation into Gemini without taking action, as well as a $5 million settlement of a separate lawsuit by the Commodity Futures Trading Commission.

- Gemini joins a number of other crypto companies such as Kraken, Circle, Bullish and Blockchain.com that are considering a public listing in the US amid a rejection of a full-scale lawsuit by the SEC.

Cryptocurrency exchange and custodian Gemini has quietly filed for an initial public offering (IPO), Bloomberg reports, citing people familiar with the matter.

The company, founded by billionaires Cameron and Tyler Winklevoss, is working with Goldman Sachs and Citigroup, the statement said, adding that a final decision on the listing has not yet been made.

The potential IPO comes after the U.S. Securities and Exchange Commission (SEC) dropped its investigation into Gemini without taking action, according to a February report from Cameron Winklevoss. The company also settled a separate lawsuit from the Commodity Futures Trading Commission in January for $5 million.

Gemini is among several cryptocurrency companies preparing to list on the U.S. public market after the SEC launched a full-scale legal probe in the early months of the Trump administration.

Bloomberg reported today that crypto exchange Kraken is eyeing an IPO by the first quarter of 2026, which is in line with reports that companies like Circle, Bullish (the parent company of CoinDesk), and Blockchain.com are also lining up to list in the U.S.