Lukka and CoinDesk Indexes to Offer Composite Ethereum Staking Rate

Lukka and CoinDesk Indexes to Introduce Composite Ethereum Staking Rate

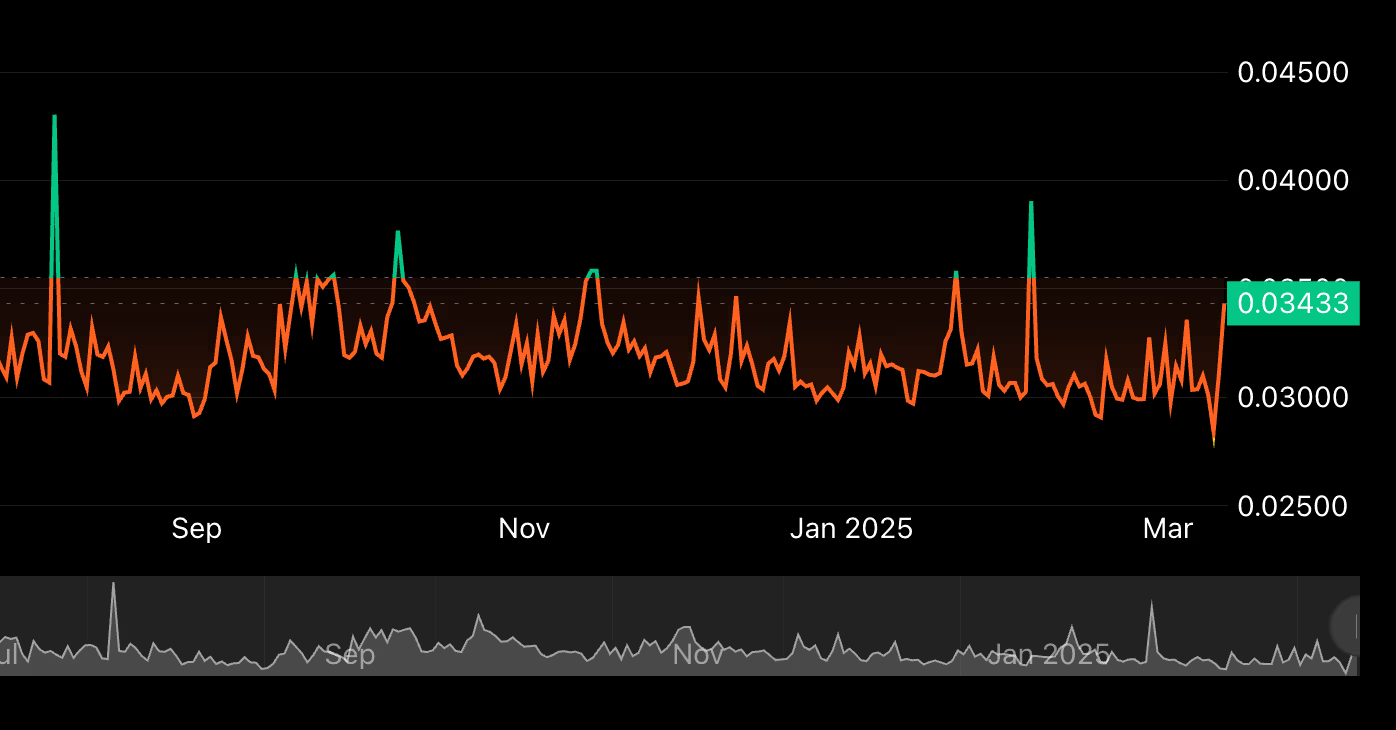

CESR reflects the average annual staking return earned by Ethereum validators.

Oliver Knight | Edited by Steven Alpher Updated March 12, 2025, 16:45 UTC Published March 12, 2025, 16:34 UTC

Important points:

- Lukka now includes Composite Ether Staking Rate (CESR) in its offerings.

- CESR represents the average annual staking return earned by Ethereum validators.

- This metric will serve as a benchmark for financial institutions when assessing the effectiveness of Ethereum staking.

US-based digital asset data provider Lukka has teamed up with CoinDesk Indices to implement the Composite Ether Staking Rate (CESR) into its products.

CESR will record the average annual staking return earned by Ethereum validators, including consensus rewards and priority transaction fees. Asset management financial institutions and analysts will be able to use CESR as a benchmark to evaluate the relative performance of Ethereum staking.

“Our collaboration with CoinFund on CESR provides an important benchmark for Ethereum staking, offering institutions a reliable and standardized rate,” said Alan Campbell, president of CoinDesk Indices.

Dan Hasher, director of data products at Lukka, added that the agreement demonstrates “a higher standard for institutional crypto data.”

Ethereum staking has increased significantly since the blockchain switched from a Proof-of-Work consensus mechanism to Proof-of-Stake in September 2022. Currently, the total value locked (TVL) in liquid staking protocols is $37 billion, allowing users to earn additional income by issuing liquid staking tokens (LST).

“Ethereum’s move to proof of stake changed blockchain security from a commitment of computing power to a financial commitment,” said Andy Baer, CFA, head of product and research at CoinDesk Indices. “Because the staking rate is essentially the utility return for staking ETH on the network, it is accessible and measurable, making it an integral part of the ETH investment case.”

UPDATE (16:45 UTC, March 12): Added quote from Andy Baer.