As Bitcoin Mining Companies Fail, Tether Ramp Up on Bitdeer

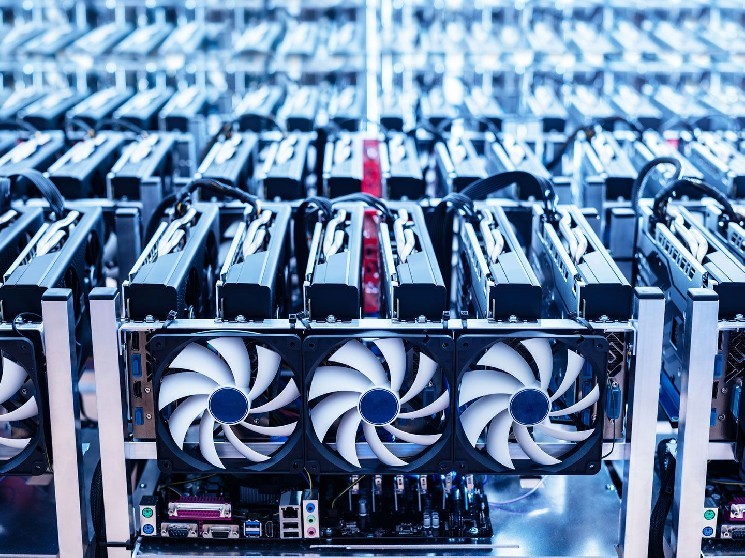

Bitcoin miners may be struggling as the world's largest cryptocurrency by market cap fluctuates sideways and investors sell off their holdings. However, stablecoin giant Tether is making a big bet on one of the sector's leading players, buying shares of publicly traded cryptocurrency company Bitdeer worth about $32 million in April.

Bitcoin miners may be struggling as the world's largest cryptocurrency by market cap fluctuates sideways and investors sell off their holdings. However, stablecoin giant Tether is making a big bet on one of the sector's leading players, buying shares of publicly traded cryptocurrency company Bitdeer worth about $32 million in April.

According to the SEC filing, Tether acquired the stock as its value was falling. Tether did not immediately respond to questions from Decrypt , but the company has stepped up its interest in bitcoin mining: It acquired a stake in Bitdeer last year, and in March, the filing showed it had increased its stake in the company to 21%.

The stablecoin company said Monday that it will also support Bitcoin mining pool Ocean by providing it with hashrate to mine blocks and earn BTC rewards.

Nasdaq-listed Bitdeer (BTDR) shares closed at $7.62 per share, down 67% year-to-date, part of an industry-wide decline caused by Bitcoin's declining popularity and a sharp increase in mining difficulty, making it harder for miners to recoup their costs.

The stock price of MARA Holdings, the largest mining company by market cap, has fallen 26% year-to-date, while shares of another major mining company, Riot Platforms, have fallen more than 38%.

According to CryptoQuant, miners have been actively selling bitcoins over the past week, likely to raise funds.

Bitcoin was recently valued at around $85,000, up 7% from last week but well below its record high of $109,000 set in January.

Tether is the company behind USDT, a digital token that operates on multiple blockchains. USDT is the largest stablecoin, the third-largest cryptocurrency by market cap, and often the most actively traded crypto token by daily volume.

As a stablecoin, it is backed by dollars, Treasuries, and other investments, so the cryptocurrency's value can be used like fiat currency — mainly to allow traders to make trades without going through banks.

However, Tether has run into legal trouble. In February 2021, the company agreed to cease operations in New York after a two-year investigation by the state attorney general found that it “made false statements about its support” for its stablecoin.

However, Tether points to quarterly confirmations and transparency reports as proof that its cryptocurrency is indeed backed as claimed. The company also confirmed to Decrypt that it is partnering with one of the Big Four accounting firms to conduct an independent audit.

Edited by James Rubin

Source: cryptonews.net