Bigcoin Mining Game Faces Ponzi Scheme Accusations Amid Token Price Fluctuations

This is an excerpt from The Drop newsletter. To read full issues, subscribe.

Abstract: The Ethereum L2 blockchain, which claims to be “the leading next-generation consumer cryptocurrency,” is introducing and supporting a cryptocurrency mining game that some have accused of being a Ponzi scheme.

Abstract has implemented the “Big Badge” as a visual reward element for users interacting with Bigcoin, an app that turns the BIG token into a game and allows players to “mine” the token using their virtual “objects.”

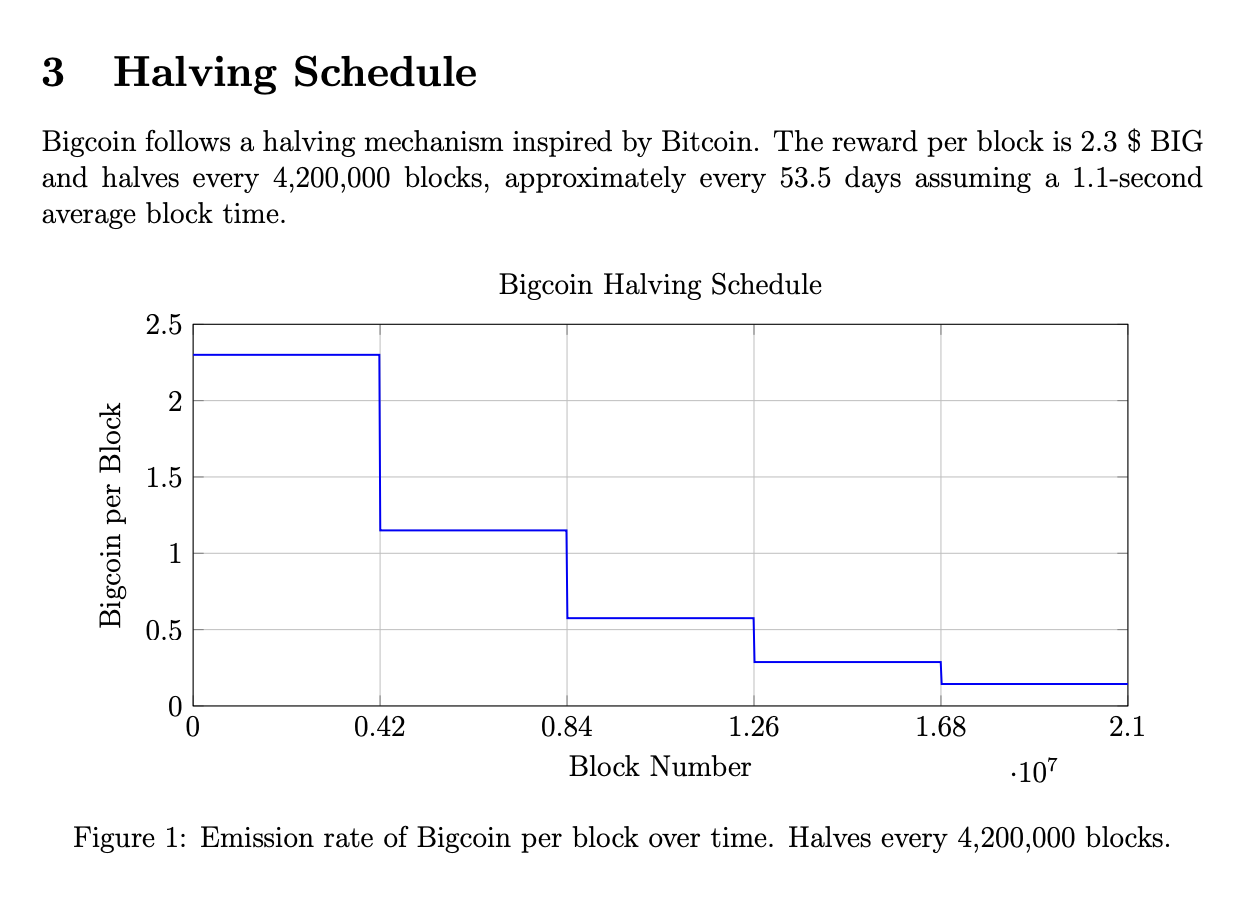

“Bigcoin aims to become the most widely known coin in the world by combining Bitcoin’s proven issuance mechanisms with viral, community-driven incentives,” the token’s white paper states. User X, known by the pseudonym “Satoshi Bigmoto” and also as “Bigtoshi,” is credited as the creator and author of the Bigcoin white paper. His account was created in February, just a few months ago.

However, in order to “mine” BIG and increase their hashrate, players need to purchase “miners” for their pixelated “facilities” using BIG directly (both the size of the facility and the number of miners contribute to the hashrate increase). Players also need to use BIG to “upgrade” these virtual mining facilities.

Fin Totten, head of annotation marketing, confirmed to me that Bigcoin does not actually use players’ physical computers to mine the token — and that the token is not actually mined. Instead, it is simulated, supported by the token’s smart contract.

Loading tweet..

One X user reported over the weekend that “Bigcoin has taken over the timeline and has generated significant gains for those who joined early,” adding, “Congrats to everyone who joined early.”

While some argue that the entire cryptocurrency is a Ponzi scheme, Bigcoin is less useful and less legitimate than its counterpart, Bitcoin, which has been adopted by Wall Street in the form of a Bitcoin ETF.

Cornell Law School defines a Ponzi scheme as: “a type of investment fraud in which investors are promised artificially high rates of return with little or no risk. Initial investors and the scammers are paid with funds from new investors, but little or no actual business activity occurs to generate income. The scheme generates funds for previous investors while there is a constant influx of funds from new participants.”

However, it is currently not entirely clear what the point of Bigcoin is, other than enriching miners who “came early” through elements of gamification.

Source: cryptonews.net