Bitcoin Hashrate Price Falls as Miners Brace for Tougher March

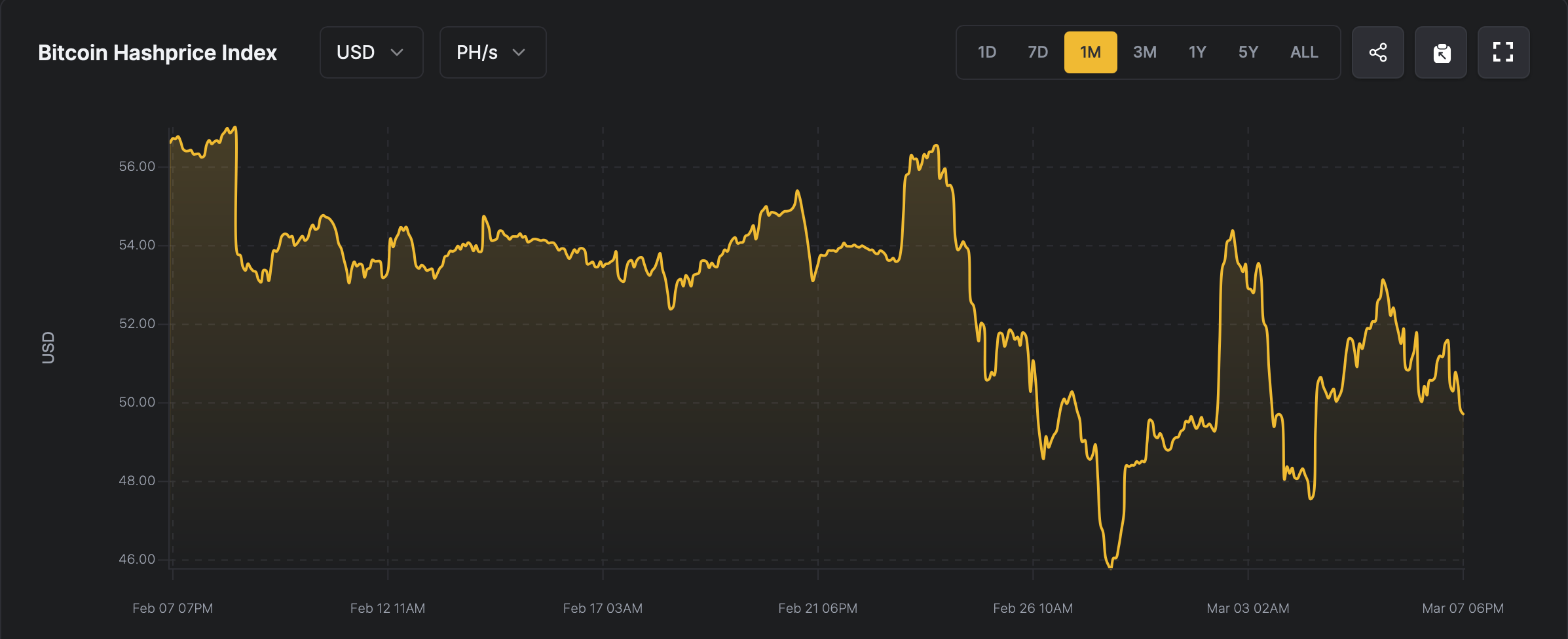

Bitcoin’s hash price — the estimated profit made from working 1 petahash per second (PH/s) of mining computing power — has fallen from $53.13 per petahash to a current value of $49.81 over the past seven days. Meanwhile, Bitcoin’s total hash rate has increased significantly since its low on February 25, adding more than 41 exahashes per second (EH/s) to current values between 794 and 796 EH/s.

March may not be a good month for Bitcoin miners as revenues decline

Bitcoin miners earned $1.24 billion in February, down from $1.4 billion in January. In the first week of the month alone, miners earned $250.75 million, including $2.97 million directly from blockchain transaction fees. By comparison, 30 days ago, Bitcoin's hash rate was $56.73 per PH/s, up significantly from today's more modest $49.81.

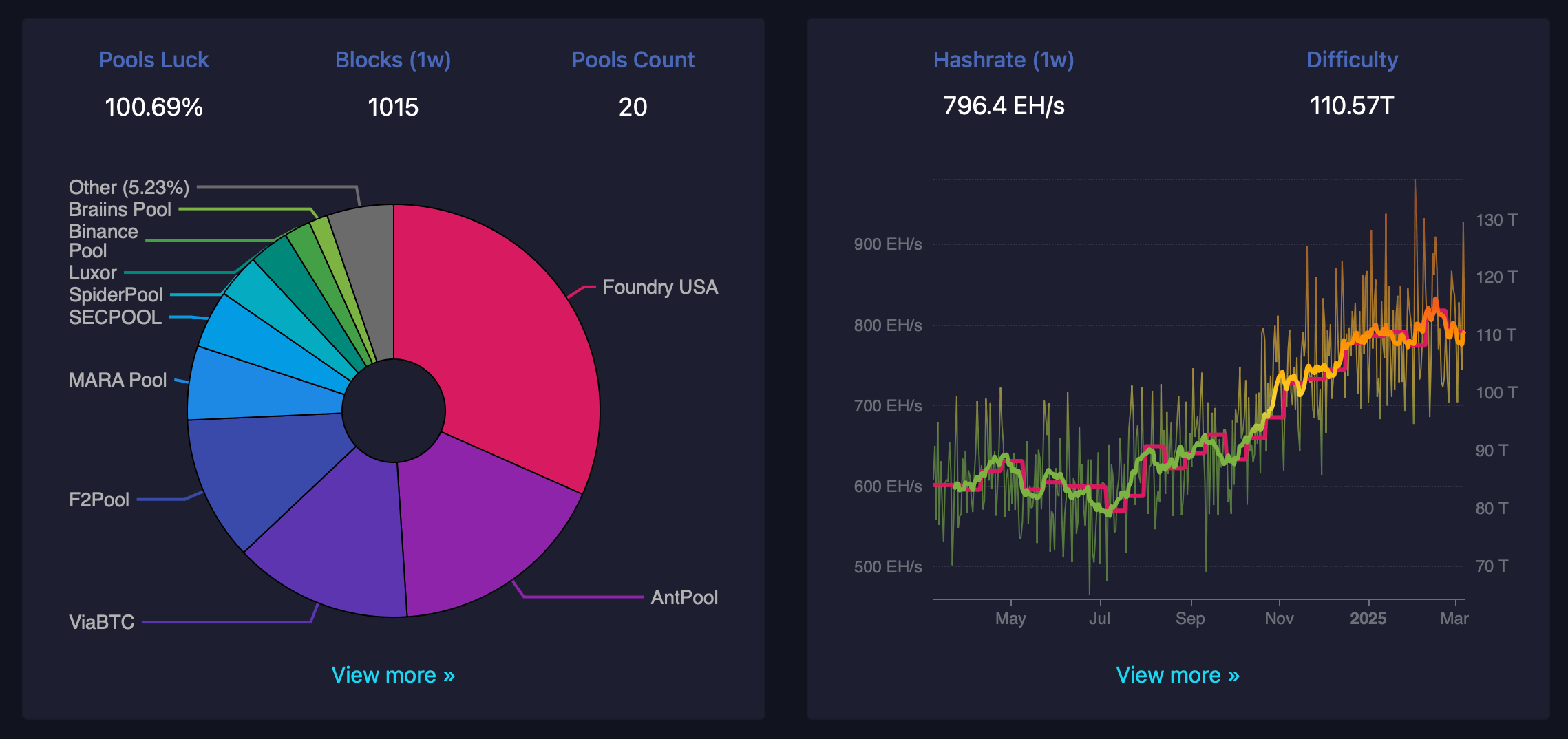

Current data suggests that March may not have the same appeal as the previous two months unless things improve. There is some optimistic news on the hashrate front, however, with mining power up a healthy 5.44% from a recent low of 753 EH/s to a healthier 794 EH/s. This total is dominated by mining pool major Foundry with a 31.43% share, while Antpool contributes a healthy 17.44%.

Viabtc is a solid third with 13.99%, giving these three mining pools combined control of 62.86% of the total Bitcoin supply of 794 EH/s. The outlook for Bitcoin miners is currently not very bright as they brace for a possible difficulty increase of around 1.29% on or around March 9th.

Blocks are currently arriving at an impressive rate, averaging around 9 minutes and 52 seconds each. Meanwhile, those looking to speed up their transactions with a high-priority transfer are facing fees averaging 3 satoshis per virtual byte (sat/vB), which is equivalent to around $0.36 per transaction. Given the current dynamics, Bitcoin miners are likely to see margin compression unless there is a significant change in market dynamics or transaction demand.

With pool control consolidating and mining costs rising, pressure on profitability could force strategic changes. Ultimately, the sector’s immediate future depends on balancing increasing network difficulty with maintaining efficient mining operations amid fluctuating revenues. And hopefully, Bitcoin’s market value will improve.

Source: cryptonews.net