Bitcoin Miner Bitdeer Looks Confident Despite Disappointing Q4 Results

Bitdeer has seen increased activity on the platform in recent days as the company makes strategic moves in the face of declining revenues and continues to implement its long-term plans.

Singapore-based, Nasdaq-listed Bitdeer bought 100 bitcoin in two transactions this week. On February 25, it bought 50 BTC at $90,280, the same day it released its Q4 2024 financial results. On February 27, it bought another 50 BTC at $81,475 each, for a total of $8,587,750. On February 23, before these purchases, Bitdeer had 911 BTC.

Bitdeer Uses Dip to Buy, Announces Share Buyback Program

On February 28, the company announced that it had completed its $9 million share repurchase program and was launching a new $20 million share repurchase program that will run through February 28, 2026. The new round of repurchases will be phased in and funded from the company's cash.

These moves come amid two quarters of declining revenue. Bitdeer Technologies Group, which includes Bitdeer AI, saw strong revenue growth in the first half of 2024. Total revenue was $119.5 million in the first quarter, compared to $72.6 million in the same quarter of 2023. It also recorded a net profit of $600,000, compared to a net loss of $9.5 million the year before.

In the second quarter of 2024, revenue was $99.2 million, compared to $93.8 million in the second quarter of 2023. Net loss was $17.7 million, compared to a net loss of $40.4 million in 2023.

Halving and market trends have negatively affected Bitdeer

The fourth Bitcoin halving in April 2024, when the block reward was reduced from 6.26 BTC to 3.125 BTC, had a significant impact on the gross profit of the entire mining industry. Bitdeer's revenue fell to $62.0 million in Q3, down from $87.3 million a year earlier. In Q4, revenue was $69 million, down from $114.8 million in Q4 2023. Net loss increased sharply from $5.0 million in Q4 2023 to $531.9 million.

In a statement following the release of its third-quarter earnings, Bitdeer Chief Business Officer Matt Kong attributed the decline to a halving of revenue, as well as an increase in global hashrate, a drop in hosting revenue, and one-time R&D expenses.

Last month also saw mining stocks fall in line with the overall stock and crypto markets, with Bitdeer suffering the biggest losses, losing 55% of its value while the industry as a whole lost $13 billion.

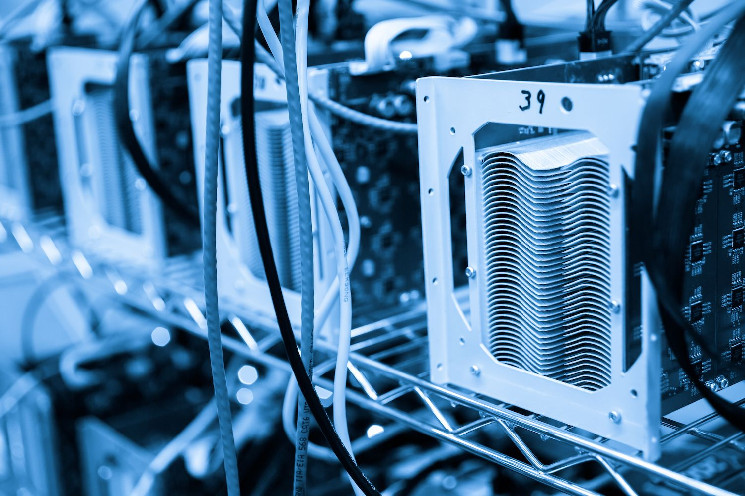

Bitdeer is actively developing ASICs

The R&D expenses Kong mentioned were for the development of the SEAL02 chip. In June, the company released a roadmap for the development of an application-specific integrated circuit (ASIC). Also in June, Bitdeer paid $140 million in stock for the DesiweMiner chip it developed and integrated its employees into the Bitdeer ASIC development team.

At that time, the first generation SEAL01 had already been released and was expected to enter mass production in the fourth quarter of 2024. SEAL02 was expected to be released in the third quarter of 2024, and SEAL03 in the fourth quarter of 2024. SEAL04 was scheduled to be released in the second quarter of 2025 for mass deliveries in the fourth quarter of 2025.

At the time of writing, Bitdeer has reserved 1,380,679 units of its SEAL A2 model and plans to begin shipping in March.

Also this week, CEO Jihan Wu expressed his intention to sell up to 4 million shares of common stock between March and June 15, 2025, under a plan finalized in December. The company emphasized that the plan complies with the U.S. Securities and Exchange Commission's Rule 10b5-1, which covers insider trading.

Source: cryptonews.net