Bitcoin Miners See $20M Drop in March Profits Due to Hash Rate Fluctuations

The March financial results show a $20 million decline in Bitcoin miner revenue compared to February. At the same time, the hash price — the theoretical daily yield of 1 petahash per second (PH/s) — has decreased by 3.93% compared to early March.

Hashprice's 3.93% decline is comparable to a record of 862 EH/s

Fresh data collected on April 1, 2025, via hashrateindex.com shows the hash price falling from $48.84 per PH/s on March 1 to the current $46.92. This amount represents the hypothetical daily profitability for 1 PH/s of mining. Despite the month-long decline, the hash price fluctuated, reaching a high of $54.38 in early March before falling to a low of $44.05 on March 10.

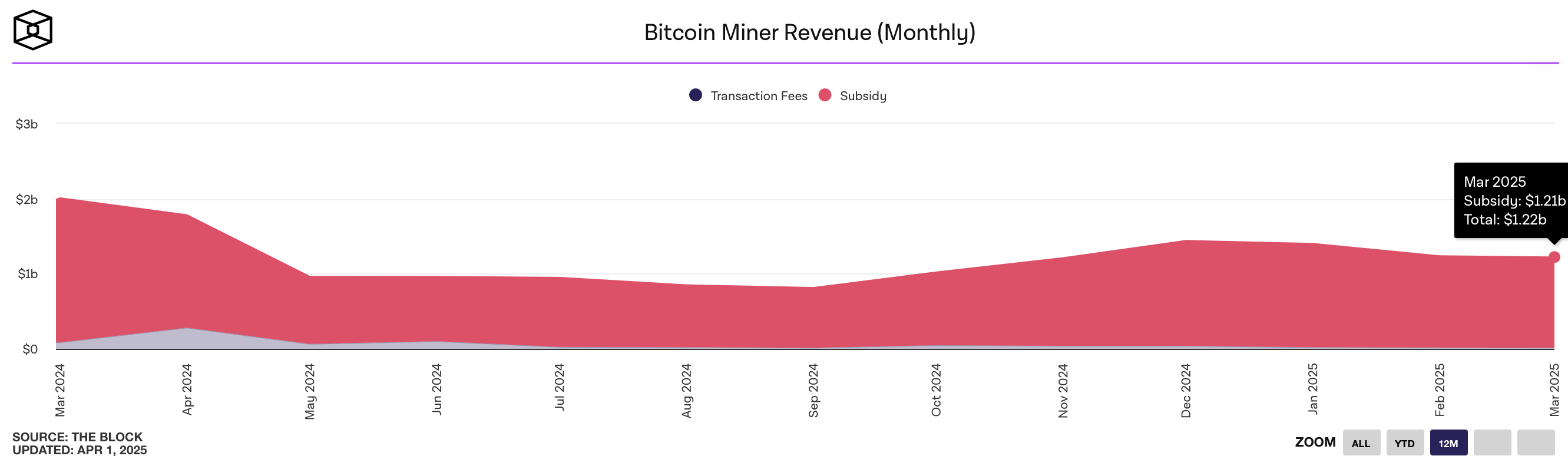

While the revenue per PH/s has decreased by 3.93% since the beginning of March, it has recovered by 6.52% from the March 10 low. Analysis shows that Bitcoin miners lost $20 million in March compared to February, according to data from theblock.co. In February, miners earned $1.24 billion, of which $1.22 billion came from subsidies. Data for March shows an accumulated $1.22 billion, of which $1.21 billion came from block subsidies.

Onchain fees accounted for $16.45 million in total in February, while March brought in $15.11 million of that flow. Additionally, Bitcoin's hash rate hit an all-time high in March, rising to 862 exahashes per second (EH/s). Block intervals have been shrinking faster than the 10-minute standard, and an expected difficulty adjustment is scheduled for April 5, 2025.

At the same time, late March and early April saw low onchain transaction throughput, with blocks having lower throughput during the day. This lull shrank to onchain fees of only 1-4 satoshis per virtual byte (sat/vB), leading to lower profit margins for mining operations.

Source: cryptonews.net