Centralization Alert: Two Bitcoin Mining Pools Have Mined Over 51% of All BTC in the Last 3 Years

Bitcoin (BTC) supporters often claim that it is the most decentralized cryptocurrency, but the reality may be different. Onchain statistics show that only two Bitcoin mining pools have mined more than 51% of all BTC over the past three years. This raises concerns about centralization on the main blockchain network.

Finbold pulled data from mempool.space, a Bitcoin data aggregator and block explorer, collected directly from an observer node. The data ranks Bitcoin mining pools by the number of blocks mined relative to the total number of blocks mined over a given time period.

For the past three years, starting on March 28, 2025, two mining pools have dominated Bitcoin block mining.

Specifically, Foundry USA managed to mine 46,076 blocks (28.72%), and AntPool mined 34,365 blocks (21.42%) out of a total of 160,432. Together, these mining pools mined 90,441 blocks, which is 56.37% of the total over the past three years.

Why is it important that only two mining pools exceed the 51% threshold?

According to the whitepaper written by Satoshi Nakamoto, the value of Bitcoin is to achieve consensus on the state of the blockchain in a decentralized way. This is achieved through Bitcoin mining, where special nodes (miners) apply computing power to decrypt cryptographic hashes and discover blocks.

After finding blocks, the miner is entitled to coinbase, which are newly created BTC units. In addition, miners can add transactions to blocks, receiving corresponding fees.

To do this, the miner needs to broadcast the block it found, along with its coinbase transaction and all third-party transactions. Other nodes, as Satoshi intended, will follow a longer chain, which means a chain with more proof-of-work attached to it, or more blocks added.

There is a theoretical threat known as a 51% attack, which could theoretically allow an attacker to double spend. Furthermore, Bitcoin mining pools can intentionally block transactions from being broadcast if they control enough mined blocks.

Finbold reported a case where F2Pool, the third largest Bitcoin mining pool, was caught (and later admitted) filtering transactions.

The Bitcoin network currently has a Nakamoto coefficient of 2. This coefficient is a metric that reflects the level of decentralization of the blockchain, determining the minimum number of independent entities (such as miners) required to control or disrupt the network.

Bitcoin mining pools, not individual miners or nodes

While each pool is supposed to be made up of different miners, there is a pool coordinator – a single entity responsible for creating a block, broadcasting it to the network, collecting rewards, and then, if they wish, distributing those rewards to their miners.

Therefore, mining pools are important structures for assessing the current state of decentralization of blockchain consensus. They are not individual miners or nodes that can migrate only when it is too late in the case of a hypothetical attack.

We have also observed cases where transaction fees were not distributed among AntPool miners as expected, but were returned to the sender.

Moreover, AntPool has also been at the center of another discovery by a well-known analyst who goes by the pseudonym b10c. The researcher claims that the data shows that the second-largest mining pool can significantly influence five other Bitcoin mining pools.

By analyzing the Merkle branches that mining pools send to miners as part of Stratum jobs, it becomes clear that BTCcom pool, Binance pool, Poolin, EMCD, Rawpool, and possibly Braiins* follow the exact same pattern and configurable transaction priority as AntPool. https://t.co/KTjFWtTXEP pic.twitter.com/xhCrdvkOH8

— b10c (@0xB10C) April 17, 2024

Finally, Bitcoin’s decentralization may be at risk because the dynamics of economies of scale increase the dominance of large miners. The more blocks a mining pool mines, the more rewards it receives from newly minted BTC and transaction fees. This allows for larger investments in infrastructure, easier access to capital, and even greater dominance in future block mining.

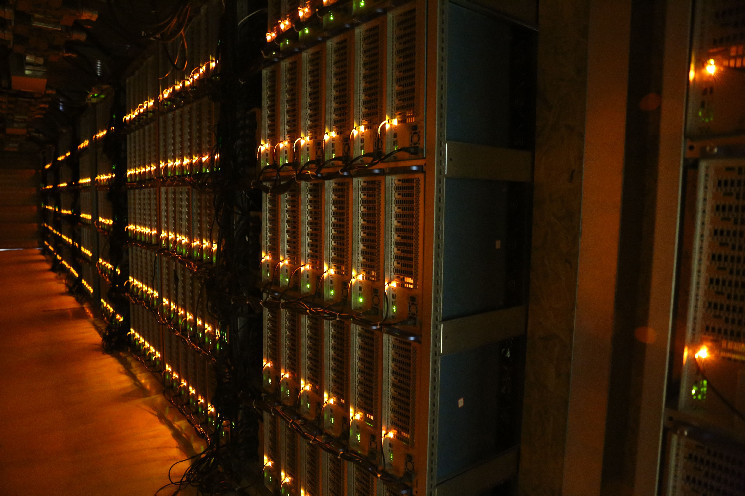

Main image courtesy of Shutterstock.

Source: cryptonews.net