Coin metrics reveal Bitcoin's global energy hunt and hidden supply chain dangers

A new Coin Metrics network health report suggests that Bitcoin miners are in a balancing act between stabilized revenues and continued fee pressure post-halving, achieved through hardware upgrades and renewable energy use amid geopolitical risks in supply chains.

Tariffs in China, renewable energy in Texas and artificial intelligence: how bitcoin mining will change in 2025

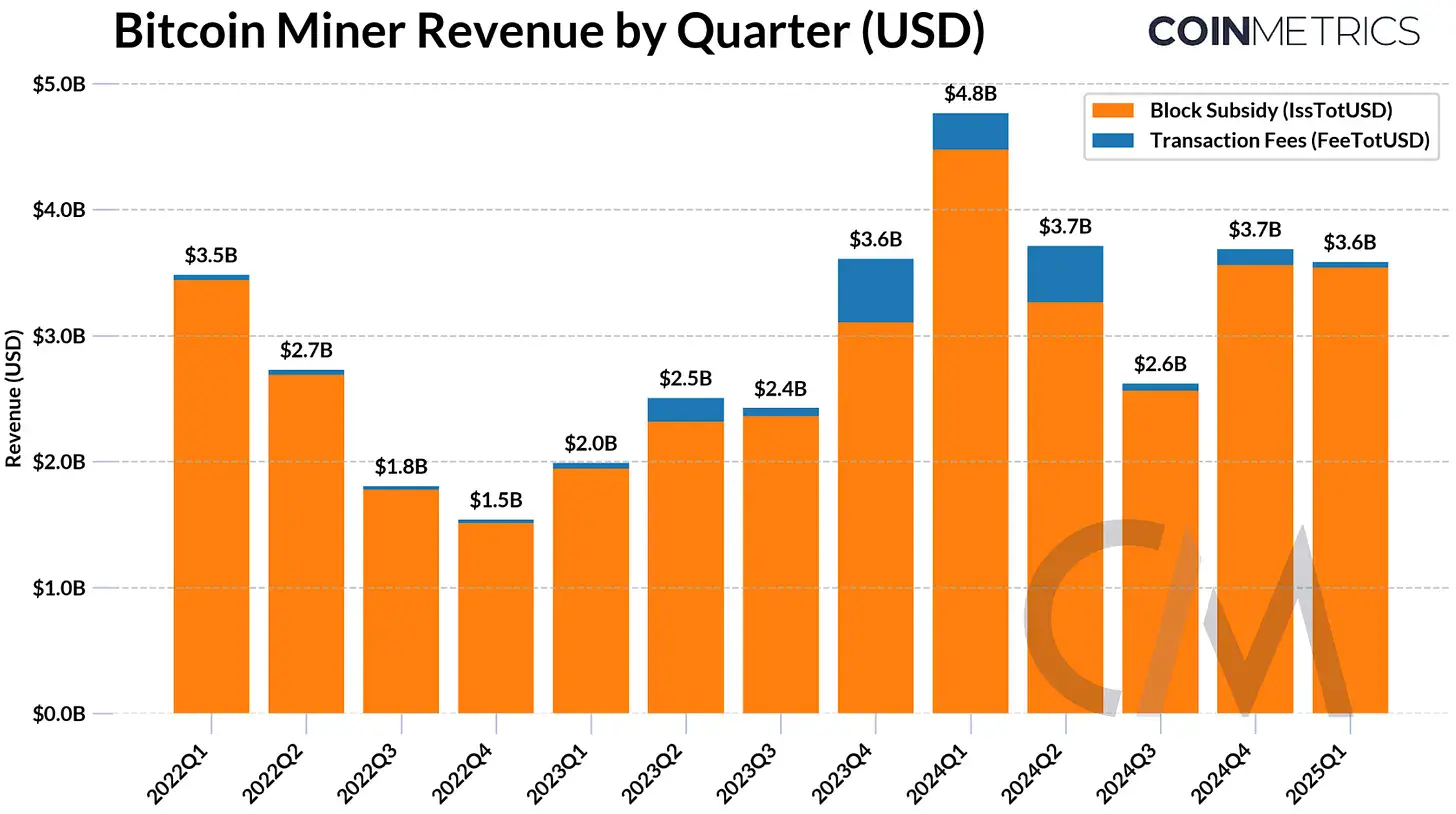

Coin Metrics’ Q1 2025 Network State report highlights the stabilization of Bitcoin mining revenues following the 2024 halving, although persistently low transaction fees — less than 2% of total revenue — continue to call long-term incentives into question. According to the report, total miner revenue was $3.7 billion in Q4 2024, up 42% from the previous quarter, thanks to improved operational efficiency and a recovery in Bitcoin prices. Coin Metrics data shows that the 30-day average hashrate increased to 807 EH/s in early 2025, indicating steady network growth.

The report notes that mining companies are increasingly turning to energy-efficient ASICs and moving to regions with more affordable renewable energy, such as Texas, as well as parts of Africa and Latin America. Larger, better-funded companies are beginning to diversify their revenue streams; Coin Metrics cites Core Scientific’s move to host AI data centers using 200 MW of existing infrastructure as an example.

The report notes that mining companies are increasingly turning to energy-efficient ASICs and moving to regions with more affordable renewable energy, such as Texas, as well as parts of Africa and Latin America. Larger, better-funded companies are beginning to diversify their revenue streams; Coin Metrics cites Core Scientific’s move to host AI data centers using 200 MW of existing infrastructure as an example.

Coin Metrics’ research raises questions about hardware centralization, noting that Bitmain’s ASICs, including the S19 series, account for 59%–76% of Bitcoin’s hashrate. This dependence creates supply chain vulnerabilities that are exacerbated by geopolitical conflicts. The report details delays in Bitmain’s shipments to U.S. miners in early 2025 due to Chinese import tariffs, illustrating the risks associated with concentrated production.

Bitcoin’s use as a medium of exchange remains limited, according to Coin Metrics, with its role increasingly shifting toward use as a store of value. However, layer 2 (L2) solutions like the Lightning Network and sidechains like Stacks aim to restore transactional utility. While the number of Lightning Network channels has declined to 52,700 in Q1 2025, the stable channel liquidity (4,500-5,000 BTC) suggests increased efficiency, according to the report.

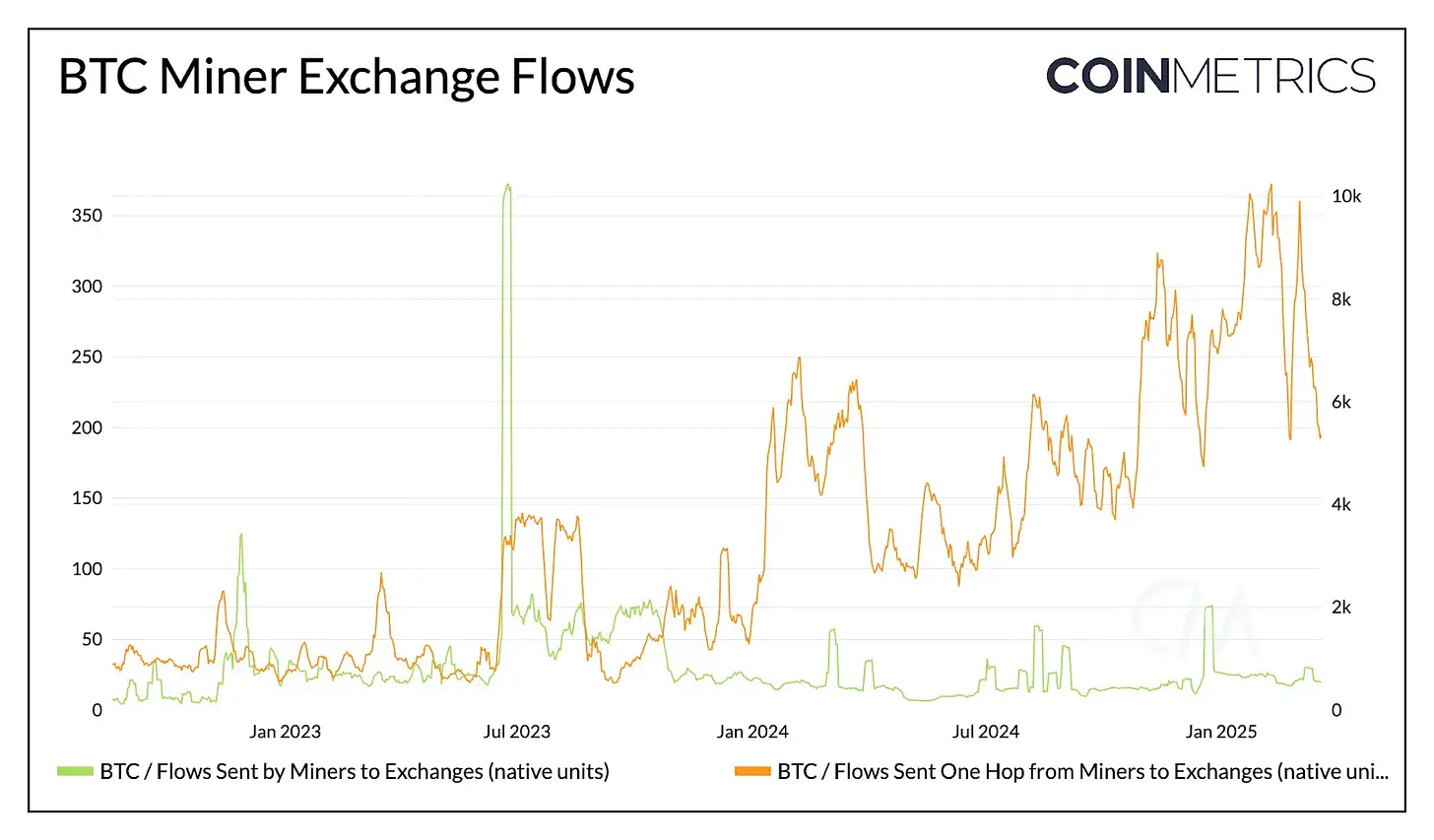

Coin Metrics exchange flow data indicates sustained selling pressure from miners, with direct (0-hop) transfers to exchanges remaining stable and indirect (1-hop) flows gradually increasing. Small miners appear to be gradually selling off their holdings, while larger operations are optimizing treasury management amid volatility.

The report concludes that maintaining miner incentives given decreasing block rewards will likely require higher transaction fees due to L2 implementation and competition for block space. Coin Metrics highlights the current dangers to network decentralization due to hardware centralization and geopolitical disruption, calling for further changes to the mining ecosystem.

Source: cryptonews.net