Is U.S. Crypto Mining in Crisis? How Trump's Liberation Day Tariffs Could Rock the Industry

Later today, US President Trump will mark what he calls Liberation Day by continuing his tariff policies aimed at reducing America's dependence on foreign goods. Depending on the severity of the tariffs, the domestic crypto mining industry could face serious losses.

In an interview with BeInCrypto, Matt Pearl, head of the Strategic Technology Program at the Center for Strategic and International Studies (CSIS), noted that tariffs on China will primarily disrupt the supply chain and raise operating costs for the U.S. mining industry.

How will Emancipation Day tariffs affect mining costs?

Later today, Trump is expected to announce sweeping tariffs on U.S. imports as part of his Liberation Day economic agenda. But information about how aggressive they will be or which countries will be at risk remains limited.

The lack of information about the event has left the public uncertain about what to expect next. In the US mining industry, participants will be watching Trump's comments on China closely.

Just over a month ago, the Trump administration imposed a new 10% tariff on Chinese goods, adding to the existing 10% tariff that was imposed just weeks earlier. During his campaign, Trump even proposed border tariffs of up to 60% on Chinese products.

If Trump imposes additional tariffs on China in connection with Liberation Day, American bitcoin miners will have many decisions to make about the nature and scope of their future operations.

ASIC Hardware: An Important Import

Crypto mining relies heavily on application-specific integrated circuits (ASICs). These chips are designed to perform the complex mathematical calculations needed to verify transactions and mine new coins. They are especially necessary for Bitcoin and other proof-of-work cryptocurrencies.

ASICs have become the leading hardware in Bitcoin mining due to their outstanding performance compared to other types of hardware, such as CPUs or GPUs. They provide significantly higher hash rates per unit of energy consumed and are designed for specific mining algorithms.

“The R&D process to create energy-efficient ASICs that do all the necessary tasks in the context of Bitcoin mining is incredibly intensive,” Pearl explained.

The United States relies heavily on imports of ASIC mining hardware, much of which comes from China. China, a longtime trade foe of the United States, has a well-developed manufacturing base for creating advanced semiconductor chips.

America's Dependence on Chinese Equipment

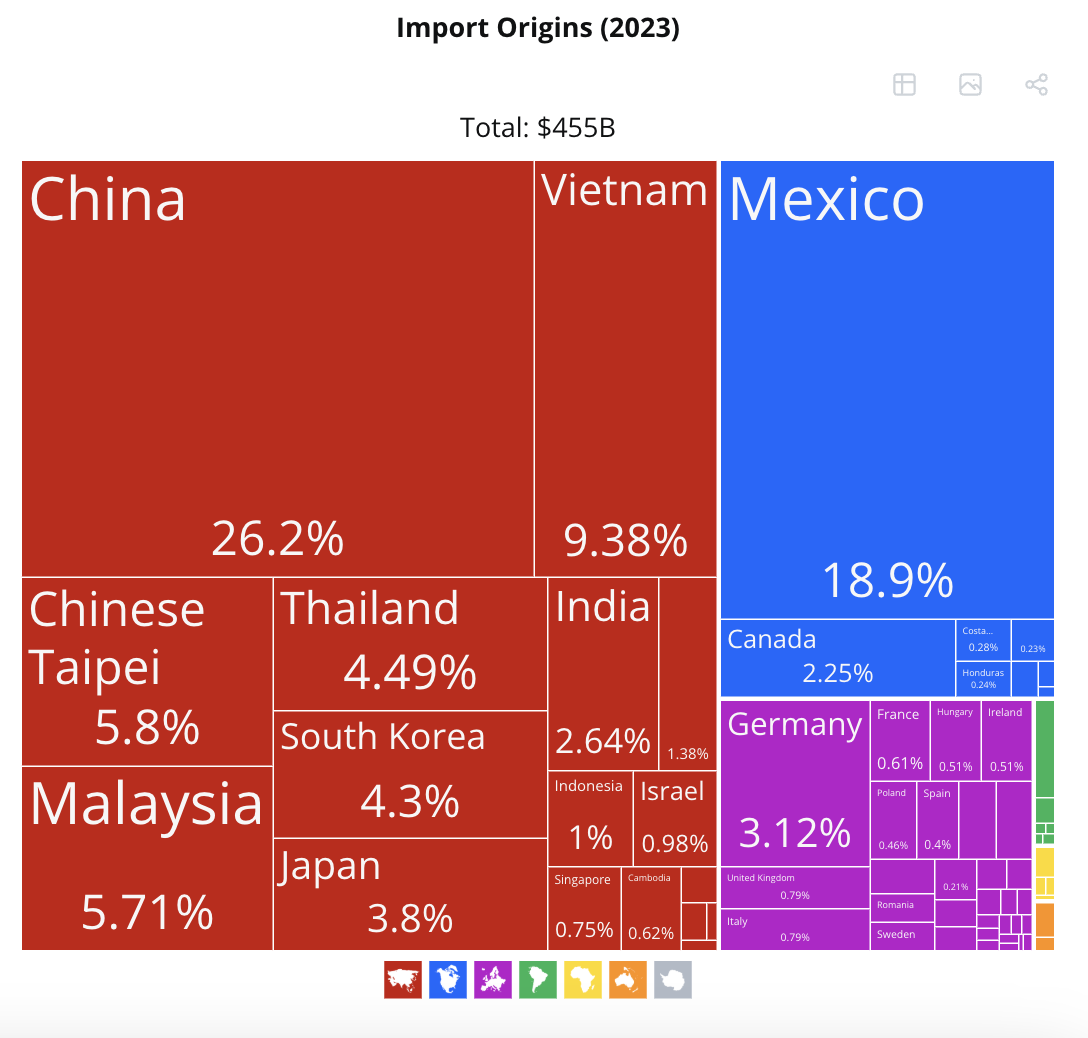

According to the Observatory of Economic Complexity (OEC), the United States became the world's largest importer of electrical and electronic equipment in 2023. It imported $455 billion worth of equipment that year, including integrated circuits (ASICs), semiconductor devices, and electrical transformers.

The United States imports the largest amount of electrical equipment from China. Source: OEC.

The United States imports the largest amount of electrical equipment from China. Source: OEC.

Electronics and electrical equipment were the second-largest import category, with China supplying $119 billion of that total, firmly cementing its position as the top supplier to the U.S.

In January 2025 alone, US electrical equipment and electronics exports totaled $19 billion, while imports reached $41.3 billion, with the majority of imports coming from China.

Given that the US relies heavily on China for this specialized equipment, any tariffs imposed on electronics imports from China will directly impact the cost of ASIC mining equipment in the US.

While Trump's tariff policies were less stringent during his first term, they provide insight into their potential impact on cryptocurrency miners.

Lessons from Trump's First Term

In June 2018, Trump’s U.S. Trade Representative reclassified Bitmain, a Chinese Bitcoin mining hardware manufacturer, from “data processing machines” to “electrical apparatus.” Bitmain, specifically its “Antminer” line, is a leading manufacturer of ASIC mining hardware.

The equipment reclassification added a 2.6% tariff to the existing 25% tariff on Chinese goods, effectively increasing the overall tariff on Chinese cryptocurrency mining equipment shipped to the U.S. to 27.6%.

Mining equipment costs are among the most significant expenses faced by US mining operators. Following the tariff hikes, cryptocurrency miners inevitably faced a sharp increase in their production costs.

The current cumulative tariffs on Chinese goods of 20% and potential further increases following Trump's Liberation Day announcements suggest a similar or even more severe impact.

“In the short to medium term, [the U.S. mining industry] is extremely vulnerable, especially given that most Bitcoin mining hardware comes from China. ASIC chips are difficult to manufacture, and this will drive up the price of Bitcoin mining hardware in the U.S. This was the case in 2018 when Trump imposed tariffs in his first term, and this time they will be even more significant,” Pearl told BeInCrypto.

Source: cryptonews.net