Bitcoin Faces Price Correction Amid Weak Demand: CryptoQuant

Bitcoin fell to a one-month low of $93,000, with analysts from CryptoQuant warning that a further decline toward $86,000 could occur unless demand growth and liquidity conditions show signs of recovery.

Bitcoin Demand Weakens, Increasing Price Correction Risks

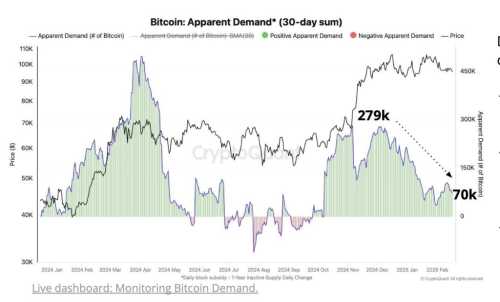

Bitcoin demand growth has weakened substantially. After a surge in November-December 2024, partly fueled by U.S. election results, demand has sharply declined from 279,000 on December 4, 2024 to just 70,000 today.

This decline in demand is further reflected in ETF activity. Bitcoin ETF net inflows, which peaked at 18,000 BTC, have reversed to a net outflow of 1,000 BTC, signaling a pullback in investor confidence.

Demand for Bitcoin from Spot ETFs is less than half of what it was at this point last year.

Net inflows

2025: 41K Bitcoin

2024: 100K Bitcoin

ETFs are simply not buying as much so far this year. pic.twitter.com/IjDGSRrvn9

— Julio Moreno (@jjcmoreno) February 19, 2025

CryptoQuant’s Inter-exchange Flow Pulse highlights declining spot Bitcoin demand in the U.S., as fewer BTC are moving from other exchanges to Coinbase.

The metric recently fell below its 90-day moving average, suggesting reduced buying interest among both institutional and retail investors.

This trend raises the likelihood of an extended price correction.

CryptoQuant Data Shows Weak Liquidity Inflows from Stablecoins

Despite stablecoins reaching a record $200 billion in total market capitalization, their expansion rate has decelerated sharply.

The 60-day change in USDT’s market cap has dropped 92%, declining from $20.4 billion on December 16 to just $1.5 billion today.

A recovery in stablecoin liquidity could play a key role in supporting Bitcoin’s price stability. Without a sustained influx of liquidity, Bitcoin may struggle to regain upward momentum.

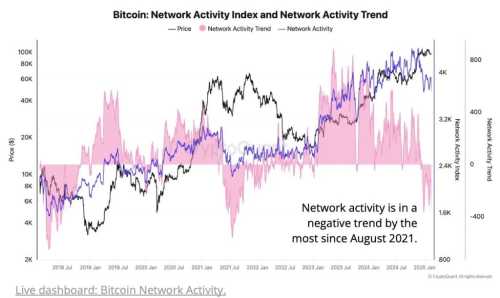

In addition to weak demand and slowing liquidity, Bitcoin network activity has fallen to its lowest level in a year, declining 17% since peaking in November 2024.

CryptoQuant’s Bitcoin Network Activity Index has slipped below its 365-day moving average for the first time since July 2021, when China banned Bitcoin mining.

This trend suggests reduced on-chain demand, reinforcing bearish conditions.

With demand weakening, liquidity inflows slowing, and network activity declining, Bitcoin remains vulnerable to further price corrections unless a shift in market conditions reverses these trends.

Investing in Uncertain Times

As Bitcoin faces pressure on multiple fronts, the discussion invites readers to embrace reflective decision-making.

The combination of subdued demand, tepid liquidity, and quiet network activity offers an opportunity to rethink one’s approach to digital investments.

It raises a critical question: how should one manage exposure in a market characterized by continuous flux?

Rather than chasing temporary optimism, this period calls for a disciplined appraisal of risk and potential.

Each piece of market data contributes to a broader narrative, urging investors to craft strategies that are both measured and informed.

Source: cryptonews.com