Crypto Scams Drive French Financial Fraud Losses to €500M Annually: AMF

France is facing a surge in financial scams, with the Autorité des Marchés Financiers (AMF) reporting that crypto-related fraud is a key driver behind the estimated €500 million in annual losses suffered by victims of financial fraud.

French authorities are intensifying their efforts to combat these scams in collaboration with the Paris Public Prosecutor’s Office, the Autorité de Contrôle Prudentiel et de Résolution (ACPR), and the Direction Générale de la Concurrence, de la Consommation et de la Répression des Fraudes (DGCCRF).

Despite a decline in reported complaints, the AMF notes that the overall scale of the fraud remains substantial.

However, the rise in scams driven by social media, influencers, and identity theft remains a significant concern, particularly as fraudsters employ deepfake videos, fake press articles, and impersonate government bodies to deceive the public.

French Scammers Stole €500M In Crypto Scam: What Else Did The AMF Discover?

Financial scams in France have expanded beyond traditional fraudulent schemes, with an increasing focus on crypto-asset investments.

The Paris Public Prosecutor’s Office estimates that €500 million is lost annually to such scams.

Crypto-related fraud has surged since the second half of 2023, which contributed significantly to these losses.

The AMF reports that the average victim of financial scams lost €29,000 by November 2024, with false savings accounts leading to even higher average losses of €69,000.

A September 2024 survey by BVA Xsight conducted for the AMF revealed that 3.2% of French adults have fallen victim to financial investment scams, a threefold increase from 2021.

The data indicates that men under 35 are particularly vulnerable. They are driven by a desire for quick wealth and misplaced confidence in their investment knowledge.

Scammers exploit this demographic by using social media platforms and promising unrealistic returns.

One alarming trend is the increase in identity theft scams. Fraudsters impersonate legitimate financial institutions, the AMF, and even government authorities.

Sometimes, they employ AI-generated deepfake videos and fake news articles featuring celebrities endorsing fraudulent crypto platforms.

Scammers have also developed sophisticated methods to pressure victims, including fake advisors who claim to protect against fraud but instead facilitate unauthorized transactions.

The phenomenon of “square fraud”—where victims of initial scams are targeted again by fraudsters posing as public officials offering to recover their lost funds—has also become prevalent.

Victims are asked to pay additional fees under the guise of legal or administrative charges, compounding their losses.

Regulatory Response and Public Awareness Initiatives

French authorities have responded aggressively to curb the rise in financial scams.

Since January 2022, the AMF and ACPR have blacklisted nearly 5,000 unauthorized investment platforms and market participants.

Additionally, they have worked to block access to 350 fraudulent websites.

Law enforcement efforts have yielded significant results. Section J2 of the Paris Public Prosecutor’s Office has seized over €645 million in criminal assets since 2020, including €268 million in 2024 alone.

Public awareness campaigns are crucial to the AMF’s strategy to prevent scams.

In 2024, the AMF and DGCCRF launched several initiatives targeting young investors through social media.

Furthermore, regulatory bodies are increasingly targeting influencers who promote unauthorized investment platforms.

The DGCCRF inspected 30 operators in 2024 and issued cease-and-desist orders to 10 influencers promoting fraudulent services.

Eight complied immediately, while legal proceedings continued against the remaining two.

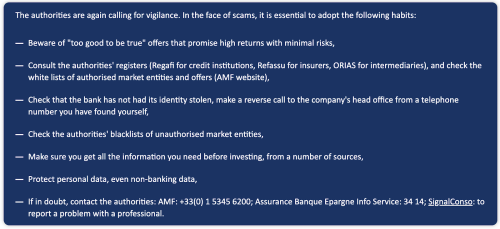

The AMF advises the public to remain vigilant and avoid offers that appear “too good to be true.”

Full recommendations below:

Source: AMF Website

Notably, Bybit was also added to the banned exchanges list in May.

Source: cryptonews.com