Franklin Templeton Expands FOBXX to Solana Blockchain

Trillion-dollar asset manager Franklin Templeton launched its tokenized money market fund, Franklin OnChain U.S. Government Money Fund (FOBXX), on the Solana blockchain on Wednesday.

Breaking news: $1.5T AUM firm Franklin Templeton’s tokenized money market fund (FOBXX) is now available on Solana!

This is finance evolving in real-time 🧵 pic.twitter.com/Yuv3otnuOk

— Solana (@solana) February 12, 2025

The company has already deployed FOBXX on Ethereum, Base, Polygon, Avalanche, Aptos, and Arbitrum.

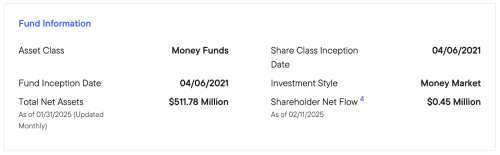

As of January 31, 2025, the fund had over $500 million in assets and invested at least 99.5% of its total assets in U.S. government securities, cash, and fully collateralized repurchase agreements.

Source: Franklin Templeton

Franklin Templeton looks to provide institutional-grade money market exposure by leveraging Solana’s high-speed, low-cost infrastructure while maintaining a stable $1 per share price.

This development comes just a day after the firm filed for a Solana Trust in Delaware, a move often seen as a precursor to an official ETF application with the U.S. Securities and Exchange Commission (SEC).

You might also like Franklin Templeton Registers Solana Trust in Delaware, Eyes Spot ETF

Solana Blockchain: Is This the Chain for Real-World Asset Tokenization?

Franklin Templeton’s latest move has added to the growing sentiment about Solana’s emergence as a major hub for tokenizing real-world assets (RWAs).

The blockchain already supports various tokenized assets, including private credit funds (Libre), government bonds (Etherfuse), real estate (MetaWealth), and commodities (dVIN Labs and BAXUS).

Franklin Templeton’s involvement adds further legitimacy to Solana’s claim as a leading network for RWAs.

With its high throughput and low transaction costs, Solana is seen as the right tool to tokenize traditional assets.

Franklin Templeton’s decision to bring FOBXX to Solana suggests growing institutional confidence in the network’s long-term ability.

New chain unlocked. BENJI is now live on @solana!

Solana is a fast, secure and censorship resistant Layer 1 blockchain encouraging global adoption via its open infrastructure.

Download the Benji app here: https://t.co/ITah6qMtns

Read more: https://t.co/4j3TDC9VHM pic.twitter.com/3aiODzkK3T

— Franklin Templeton Digital Assets (@FTDA_US) February 12, 2025

Meanwhile, this development aligns with a broader industry trend in which major financial institutions are exploring blockchain-based solutions to enhance liquidity and transparency in traditional markets.

BlackRock’s CEO, Larry Fink, has been a strong advocate for tokenization.

In a recent interview with Bloomberg at the World Economic Forum in Davos, he stated that tokenizing bonds and stocks could democratize investing in ways we can’t yet imagine.

Institutional Adoption and Solana’s Future Prospects

Franklin Templeton’s expansion into Solana reflects a broader shift in institutional interest toward blockchain-based financial products.

The firm’s latest initiative strengthens Solana’s position as a leading blockchain for tokenized securities, with expectations that more traditional financial institutions will follow suit.

This sentiment is shared by industry leaders, including SkyBridge Capital founder Anthony Scaramucci, who recently stated that Solana is well-positioned to win the tokenization race.

Speaking on CNBC, Scaramucci mentioned that Solana’s efficiency and low transaction costs make it the ideal blockchain for tokenizing stocks, bonds, and other real-world assets.

His remarks align with Franklin Templeton’s belief that Solana will become the third-largest cryptocurrency, trailing only Bitcoin and Ethereum.

As mentioned earlier, this latest decision followed a recently filed Solana Trust in Delaware. Franklin Templeton joined Canary Capital and Grayscale in the race for a Solana spot ETF.

🏛️ Franklin Templeton has filed for a Solana spot ETF trust, joining Grayscale and Canary Capital in the race for SEC approval. Will Solana ETFs gain traction?#SolanaETF #CryptoETFshttps://t.co/YSb2pz1kxQ

— Cryptonews.com (@cryptonews) February 11, 2025

If approved, the ETF would offer institutional investors regulated exposure to Solana (SOL). The SEC has already acknowledged Canary Capital’s Solana ETF application, triggering a 21-day review period, while VanEck initiated the trend with its June 2024 filing.

The SEC’s stance on crypto ETFs has evolved since it approved Bitcoin spot ETFs in January 2024 and later extended them to Ethereum ETFs.

Now, firms compete to launch ETFs for other cryptocurrencies, such as Solana and XRP.

Franklin Templeton has also advanced its Bitcoin-Ether ETF, pending SEC approval since September 2024.

NEW: @EricBalchunas and I took a look at the filings for spot crypto ETFs. We're putting out relatively high odds of approval across the board. Mainly focused on Litecoin, Solana, XRP, and Dogecoin for now.

Here's the table with the odds and some other details: pic.twitter.com/xaXaNXLb0M

— James Seyffart (@JSeyff) February 10, 2025

Analysts project a 70% chance of Solana ETF approval, with final decisions expected by mid-March 2025.

Source: cryptonews.com