Tesla Sees $600M BTC Profit Jump After Accounting Rule Change

A recent rule change on digital asset accounting helped Tesla boost its net income in the fourth quarter.

Tesla’s digital asset value remained at $184m for four consecutive quarters before jumping to $1.08b in the December quarter.

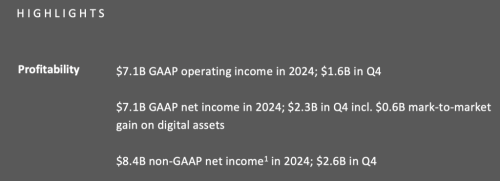

However, in its Q4 2024 earnings report on Wednesday, Tesla did not disclose its Bitcoin holdings. Instead, it reported a $600m mark-to-market gain on digital assets.

According to Arkham Intelligence, Tesla currently holds 11,509 BTC, valued at about $1.19b.

Tesla missed analysts’ expectations for fourth-quarter earnings and revenue, as auto revenue declined 8% year-over-year. Despite this, the stock rose 4% in after-hours trading.

Source: Tesla

Crypto Accounting Rule Change Allows Companies to Reflect Market Value Gains

The Financial Accounting Standards Board (FASB) introduced a new policy, effective in 2025, requiring companies to adjust their digital asset holdings to market value each quarter.

This “mark to market” approach ensures assets reflect current market prices instead of historical costs. Previously, companies holding Bitcoin had to report it at its lowest recorded value, ignoring any later price increases.

Tesla adopted the new accounting rule early, ahead of the 2025 deadline requiring compliance for fiscal years after Dec. 15, 2024.

Previously, Tesla could only record losses when Bitcoin’s price dropped and couldn’t recognize gains unless it sold the asset. Now, the updated rule allows companies to adjust crypto holdings quarterly, aligning their valuation with stocks and other financial assets.

Tesla Acknowledges New Crypto Rule as Key Driver Behind $600M Bitcoin Gain

Tesla reported in its earnings deck that the rule change increased earnings per share by 68 cents for the quarter.

“It’s important to point out that the net income in Q4 was impacted by a $600m mark-to-market benefit from Bitcoin due to the adoption of a new accounting standard for digital assets,” CFO Vaibhav Taneja said.

At the end of Q3, Tesla valued its Bitcoin holdings at $184m, but their fair market value stood at $729m. This gap shows a $347m increase, reflecting Bitcoin’s surge in Q4.

Bitcoin’s recent rally has been fueled by optimism over Donald Trump’s potential second term.

During his campaign, Trump shifted from skepticism to a pro-crypto stance. He pledged to make the US the “crypto capital of the planet,” proposing a national Bitcoin reserve and appointing crypto-friendly regulators.

After the election, Bitcoin and other cryptocurrencies saw major price jumps. Since Trump’s November win, Bitcoin’s value has risen by over 50%.

Source: cryptonews.com