Tether Backs Euro Stablecoin Startup StablR

Tether, the company behind the world’s largest stablecoin USDT, has announced its investment in StablR, a European startup specializing in euro-denominated stablecoins.

According to Tether’s press release from Dec. 17, by backing StablR, the company aims to increase the adoption of stablecoins in the European economy and expand its reach across the continent.

The amount of the investment was not disclosed.

Driving Stablecoin Adoption in Europe

Tether will leverage StablR’s expertise in the European financial landscape to promote the use of stablecoins for everyday transactions. This includes facilitating their integration into various sectors like finance, commerce, and technology.

StablR will leverage Tether’s newly launched tokenization platform, Hadron, for its operations and services.

Launched just last month, Hadron simplifies the process of converting various assets such as stocks, bonds and commodities into digital tokens. The platform provides an easy-to-use interface for managing the entire token lifecycle and includes a suite of compliance tools covering Know Your Customer (KYC), Know Your Transaction (KYT), Anti-Money Laundering (AML), and risk management.

Super excited for StablR investment!

Tether has become the tech infrastructure provider for European regulated stablecoins with Hadron by Tether @hadron_tether

Hadron is a platform-as-a-service built to tokenize any asset (stablecoins, stocks, bonds, funds, real-estate),… https://t.co/HzKiswUqjc

— Paolo Ardoino 🤖🍐 (@paoloardoino) December 17, 2024

StablR to Expand Stablecoin Ecosystem

StablR obtained an Electronic Money Institution (EMI) license from the Malta Financial Services Authority in July 2024. This license allows StablR to issue stablecoins that comply with the European Union’s Markets in Crypto-Assets Regulation (MiCA).

StablR currently offers two stablecoins, EURR and USDR. Both are available as ERC-20 and Solana-compatible tokens, enabling them to be transferred to any compatible wallet address.

StablR plans to expand its stablecoin offerings to additional blockchain networks using Tether’s Hadron platform, recognizing the growing need for stablecoins in Europe and worldwide.

“We’ve seen an incredible surge in the global stablecoin market, perfectly aligned with the growing momentum of the digital assets economy,” said Gijs op de Weegh, Founder and CEO at StablR. “Just last month, the global stablecoin market shattered records, reaching an unprecedented market cap of $190 billion.”

Stablecoins Overtake Bitcoin as the Go-To for Daily Transactions

Stablecoins have become a significant force in the cryptocurrency market, accounting for more than two-thirds of the trillions of US dollars worth of cryptocurrency transactions recorded in recent months.

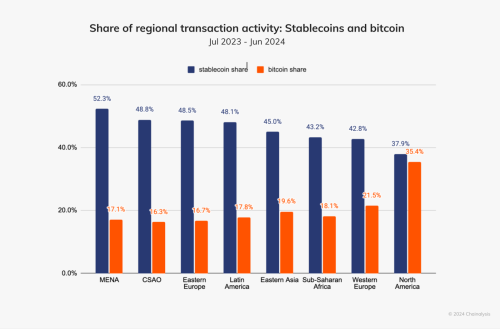

According to the latest Chainalysis report, the stablecoin market is overtaking Bitcoin (BTC) as the asset of choice for everyday transactions.

Stablecoins are rapidly gaining popularity for daily transactions, surpassing Bitcoin. Source: Chainalysis

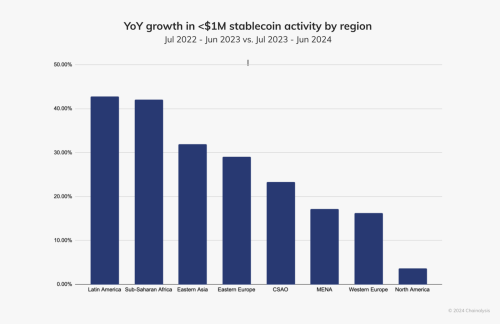

Stablecoins are becoming increasingly useful in regions facing economic challenges, such as Latin America and sub-Saharan Africa, where stablecoin usage has grown by more than 40% year-on-year. In these areas, people are using stablecoins to protect their savings from local currency instability and to access basic financial services.

Eastern Asia and Eastern Europe also show strong growth in stablecoin usage, with increases of 32% and 29% respectively.

Stablecoins are proving vital in economically challenged regions like Latin America and sub-Saharan Africa. Source: Chainalysis

While stablecoin adoption in North America and Western Europe is comparatively slower, likely due to existing robust financial infrastructure, it’s still significant. According to Chainalysis, institutional players in these regions are turning to stablecoins for efficient liquidity management, settlements, and easier access to the cryptocurrency market.

However, Western Europe, and particularly the UK, has emerged as a major hub for merchant services using stablecoins. This sector has seen substantial growth, with stablecoins consistently capturing 60-80% of the market share each quarter.

Source: cryptonews.com