Bitget becomes second-largest crypto exchange ecosystem by userbase

- Bitget’s users expanded from 20 million to 100 million in 2024

- Spot trading volumes increased from $160 billion in Q1 to $600 billion in Q4

- Bitget’s native token, BGB, increased by over 1,000%, reaching $8 in 2024

Crypto exchange Bitget has experienced a surge in users with a growth of 400% over the past 12 months.

The platform has emerged as the second-largest crypto exchange after seeing its users expand from 20 million in January to over 100 million in December, according to its 2024 transparency report. This expansion was matched by significant advancements in trading activity, with daily volumes doubling to $20 billion.

Driven by innovation, strategic business decisions and a strong demand for trustworthy platforms, Bitget has seen one of its most successful years since the company launched in 2018. This is highlighted by spot trading volumes increasing, rising from $160 billion in Q1 to $600 billion in Q4.

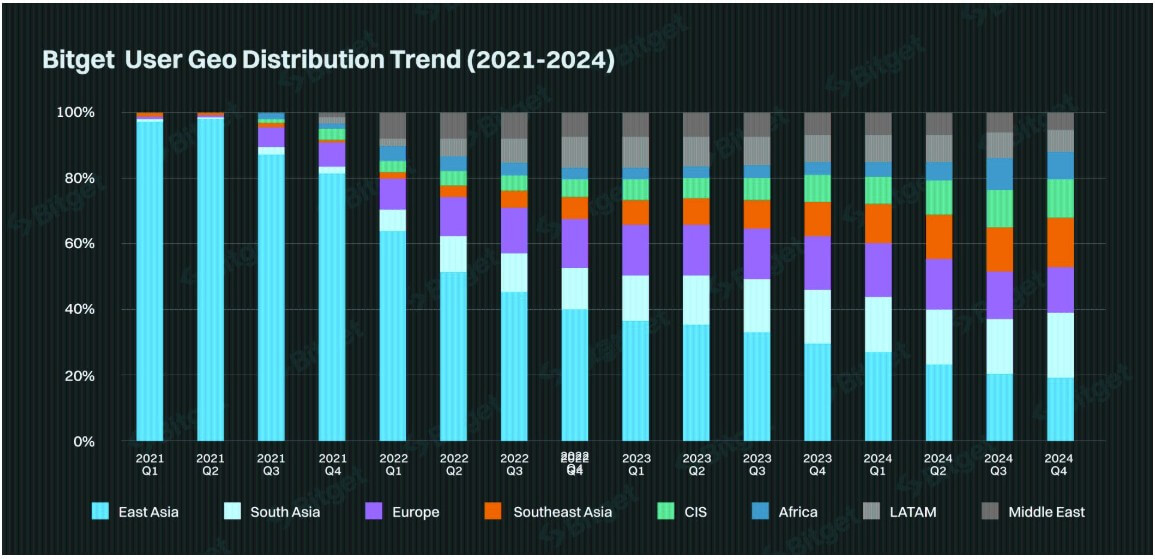

Global reach

Bitget’s diversification also played a role in its success in 2024.

South Asia emerged as a significant player, rising from under 5% in 2021 to around 15% in 2024. Southeast Asia saw a similar increase, growing from 5% in 2021 to nearly 12% last year. In Europe, users rose by 10% compared to 6% in 2021.

Significantly, Latin America and the Middle East grew from negligible shares in 2021 to 8% and 6%, respectively, by 2024. The Commonwealth of Independent States (CIS) region made up around 5% of users in 2024, an increase from less than 2% in 2021, while Africa rose from below 1% to 4% in the same time.

TON investment

Bitget also made a $30 million strategic investment with Foresight Ventures in The Open Network (TON). By doing so, it aligns with its support for emerging trends like GameFi and Tap-to-Earn. TON’s rapid growth in transaction volumes and decentralized app adoption also played a significant role in leveraging market opportunities.

Bitget’s native token, BGB, grew by over 1,000% with its value increasing tenfold to reach $8 by year-end. A newly implemented burn mechanism, combined with enhanced token utility and an updated whitepaper, contributed to this growth.

By reducing total supply and introducing a quarterly token burn program, Bitget positioned BGB as the core of its ecosystem’s future growth.

Leadership changes

In 2024, leadership transitions further defined Bitget’s trajectory.

Gracy Chen, previously the Managing Director, assumed the role of CEO, becoming the only female leader among the top 10 global exchanges. Alongside her, Hon Ng was appointed Chief Legal Officer, Vugar Usi Zade as the Chief Operating Officer, and Min Lin as Chief Business Officer.

This strong leadership team has been strategic in driving important initiatives, compliance advancements, and user-focused developments.

With this, Bitget obtained key approvals, including a UK license, a Bitcoin Service Provider (BSP) license in El Salvador, and launched a localized exchange in Vietnam. These advancements operate in alignment with regional standards while expanding its global presence.

Bitget also made strides in corporate social responsibility through initiatives like Blockchain4Her, which promotes gender diversity in blockchain, and Blockchain4Youth, spreading blockchain awareness among young professionals worldwide. These programs reflect the exchange’s broader vision of enabling inclusive growth within the Web3 space.

With its strategic investments, regulatory successes, and user-centric innovations, Bitget enters 2025 bound for continued expansion and influence within the crypto ecosystem. The past year’s achievements shows the platform’s strategic vision in shaping the future of blockchain and crypto.