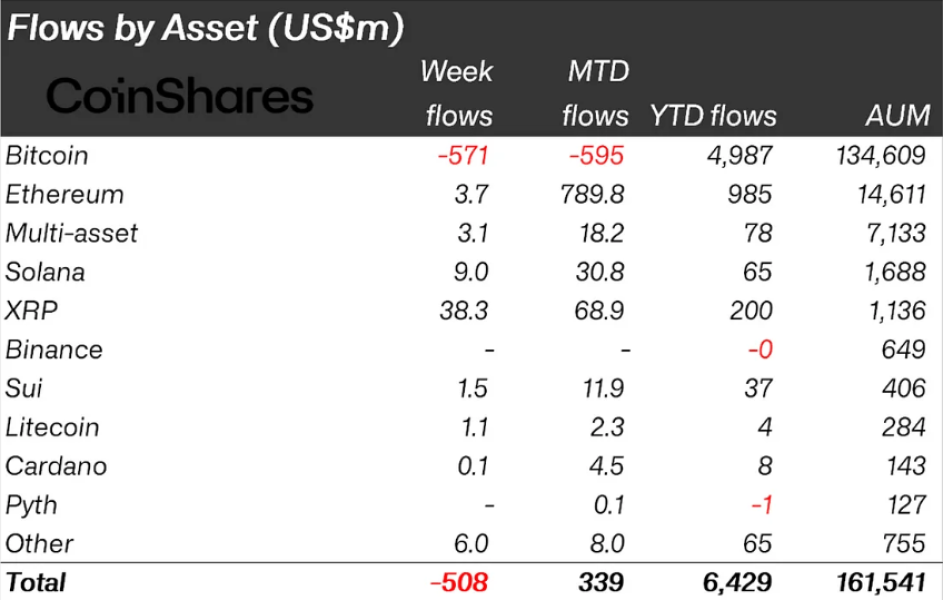

$508 million withdrawn from crypto exchanges in a week

Last week, users withdrew $508 million worth of cryptocurrency from exchanges. Over the past two weeks, the total outflow has reached $925 million.

Market sentiment is changing after 18 weeks of gains as investors weigh the impact of economic developments in the U.S., as well as uncertainty over trade tariffs, inflation and monetary policy.

Bitcoin under pressure

According to CoinShares, Bitcoin (BTC) saw the largest outflow of funds at $571 million. At the same time, some traders increased short positions, leading to an influx of $2.8 million into short products on Bitcoin.

The trend continues the downward trend from the previous week, when the Fed's tough stance and new consumer price index data triggered the first capital outflow from the crypto market in 2025. CoinShares notes that investors are showing increased caution amid analysis of US economic data.

“Investors have adopted a wait-and-see attitude since the inauguration of the US president, given the uncertainty surrounding Trump’s trade tariffs, inflation and monetary policy, as evidenced by the decline in trade turnover from $22 billion to $13 billion over the past two weeks,” the report said.

The largest outflow was recorded in the United States – $560 million, which increases concerns about the country's economic policy.

Altcoins are in demand

Meanwhile, altcoins continue to attract capital. XRP saw an inflow of $38.3 million, bringing the total investment to $819 million since mid-November 2025.

XRP's success is linked to expectations of the SEC's decision on the ETF for this asset. The official period for consideration of applications by the regulator has begun, and investors are counting on clarification of the regulatory status.

The approval of an XRP ETF could attract institutional investors and strengthen the altcoin’s position during a period of market volatility. Optimism has been fueled by the SEC’s acceptance of Bitwise’s XRP ETF application and Hashdex’s launch of a similar product in Brazil.

Other altcoins are also attracting investments: Solana – $9 million, Ethereum – $3.7 million, Sui – $1.5 million. This may indicate a shift in investor interest from Bitcoin to altcoins with more attractive technical characteristics and growth potential.

The market is awaiting the release of important US economic data: GDP data on Thursday and PCE inflation on Friday. These indicators could significantly influence the Fed's policy.

Bitcoin is becoming increasingly sensitive to the macroeconomic situation, and unfavorable statistics can increase sales. At the same time, altcoins benefit from speculative interest and investors' desire for diversification.

The growing gap between Bitcoin and altcoins could signal structural changes in the market. Some analysts are already talking about the start of an “altcoin season.”

Источник: cryptocurrency.tech