Bybit Responds to Token Listing Fee Accusations

Cryptocurrency exchange Bybit has officially denied accusations that it is demanding $1.4 million to list its tokens. The company also denies using influencers to pressure students participating in its affiliate program. The statements were published after accusations were made on social media site X (formerly Twitter).

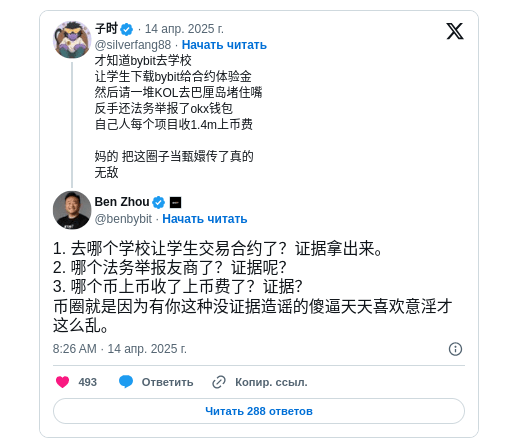

On April 14, 2025, a user with over 100,000 followers, silverfang88, accused the platform of inflated listing fees and unethical behavior in its Campus Ambassador student program. The company allegedly uses key opinion leaders (KOLs) to suppress discontent among its members.

Bybit CEO Ben Zhou denied the allegations and demanded concrete evidence from the complainant. The exchange representative clarified that the platform requires a deposit of $200,000 to $300,000 in stablecoins, which is used to cover advertising costs. If Bybit does not achieve the set goals, then penalties are applied to it, the company representatives emphasized.

“Assessments focus on fundamentals and risk controls, including on-chain data, address authenticity, use cases, user distribution, project valuation, token valuation, value capture mechanisms, and team credentials,” the company said.

According to Bybit, the listing process includes a formal application, internal discussions, and review of the project against a number of criteria. These include on-chain activity, token valuation, user base, and team reputation. The exchange also emphasized that it does not directly hold tokens for legal reasons.

The allegations surrounding the 2024 student program relate to the provision of trial contracts and alleged pressure on participants. Bybit's CEO has not provided a direct response to this issue at the time of publication, limiting himself to calling for evidence of violations.

Источник: cryptocurrency.tech