Bitcoin (BTC) Mining Profitability Drops 7.4% in March

Bitcoin mining profitability fell 7.4% in March due to falling prices and transaction fees, Jefferies reports

The report said the decline in profitability was due to an 11.2% drop in the price of Bitcoin and a 9.1% decrease in transaction fees.

Will Canny | Edited by Stephen Alpher on April 14, 2025, 2:28 PM

What you should know:

- Bitcoin Mining Profitability Down 7.4% in March, Jefferies Says

- The report highlighted that the decline was due to an 11.2% drop in the average price of Bitcoin and a 9.1% decrease in transaction fees.

- Bitcoin outperformed the broader U.S. stock market in April, possibly due to the weakening dollar, according to the bank.

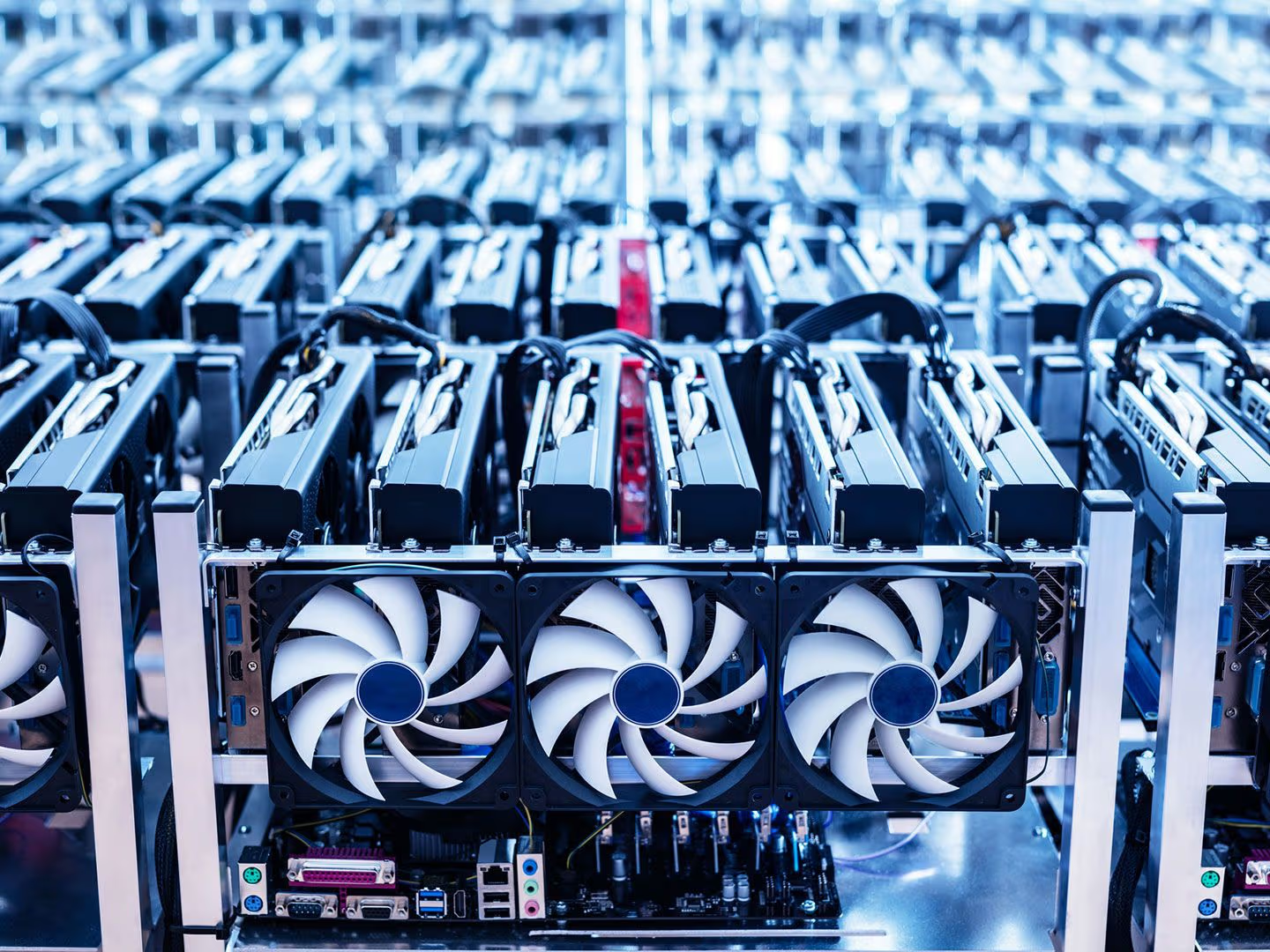

Investment bank Jefferies said in a research report on Friday that Bitcoin (BTC) mining profitability fell 7.4% in March.

The report said the decline was due to an 11.2% drop in the average price of Bitcoin and a 9.1% decrease in transaction fees.

Miners listed on U.S. exchanges mined 3,534 bitcoins in March, up from 3,002 in February, according to Jefferies. These companies accounted for 24.8% of the total network last month, up from 23.6% the previous month.

The report said that MARA Holdings (MARA) mined the most bitcoins in March with 829 tokens, followed by CleanSpark (CLSK) with 706 BTC.

The report also mentions that MARA has the highest installed hashrate at 54.3 EH/s, while CleanSpark comes in second at 42.4 EH/s.

Looking at April, Jefferies noted that Bitcoin remained broadly stable while the S&P 500 stock index fell 6%. The weakening US dollar may be one reason for this outperformance, the bank said.

Read more: US-listed Bitcoin miners lost 25% of their market cap in March: JPMorgan