Cryptocurrency Payments Firm Mesh Raises $82M Amid Stablecoin Spread

Cryptocurrency Payments Firm Mesh Raises $82 Million Amid Stablecoin Rise

The funding was completed using PayPal's PYUSD stablecoin and was managed by Paradigm.

Christian Sandor | Edited by Nikhilesh De Updated Mar 11, 2025 7:42 PM UTC Published Mar 11, 2025 7:01 PM UTC

Key facts:

- Cryptocurrency payments company Mesh has raised $82 million in a Series B round to expand its global stablecoin-based settlements network.

- The bulk of the funds were raised in PayPal's PYUSD stablecoin.

- The company is building a network that allows users to make payments using cryptocurrency and merchants to make transactions in stablecoins.

Cryptocurrency payments company Mesh announced on Tuesday that it has raised $82 million to expand its global stablecoin-based settlement network.

Series B was led by Paradigm, with participants including ConsenSys, QuantumLight, Yolo Investments, Evolution VC, Hike Ventures, Opportuna and AltaIR Capital.

According to the press release, the majority of the funds raised were placed in PayPal's PYUSD stablecoin.

Mesh is developing a blockchain-based payment network that connects crypto wallets with payment service providers for merchants. With Mesh, users can pay with crypto assets such as Bitcoin (BTC), Ethereum (ETH), and Solana’s SOL, while merchants accept payments in their choice of stablecoins, including Circle’s USDC, PayPal’s PYUSD, and Ripple’s RLUSD.

“Regulatory clarity is starting to emerge, institutions are leaning in, and stablecoins are maturing,” Bam Azizi, CEO and co-founder of Mesh, said in a LinkedIn post on Tuesday. “With these tools, we are expanding globally, making crypto payments as convenient as using a credit card.”

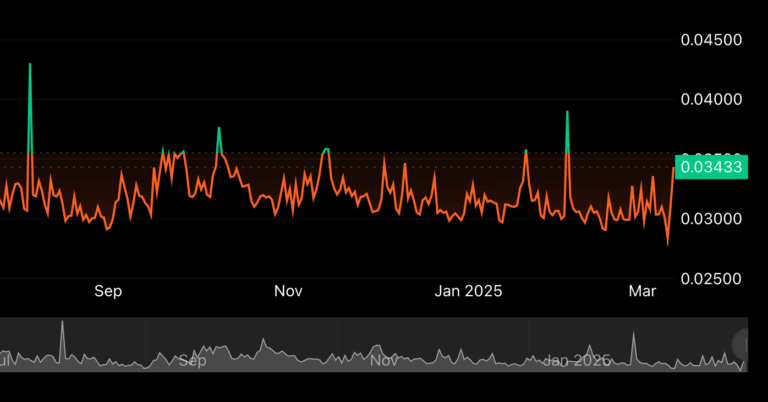

Stablecoins are one of the fastest growing segments in the cryptocurrency space and have reached $200 billion as an asset class in digital financial instruments. Pegged to an external asset, mainly the US dollar, they play a key role in the infrastructure for trading digital assets. They are also becoming increasingly popular for payments, savings, and remittances, especially in developing countries, offering a cheaper and faster alternative to traditional banking systems.

Due to the rapid growth, venture capital firms are increasingly investing in projects related to the creation of services and infrastructure for stablecoins. Felix Hartmann, founder and managing partner of investment firm Hartmann Capital, said in a report on Tuesday that “stablecoins are becoming a major part of cryptocurrency trading” as they, along with tokenized financial assets, will lead the next wave of growth in digital asset adoption.

Payments giant Stripe's $1.1 billion acquisition of stablecoin platform Bridge last year was a landmark move that highlighted the potential of stablecoins in the global payments industry.