How Centralization Issues Fueled the Decentralized Exchange Hype

How HyperLiquid Storage Buzz Died Due to Centralization Concerns

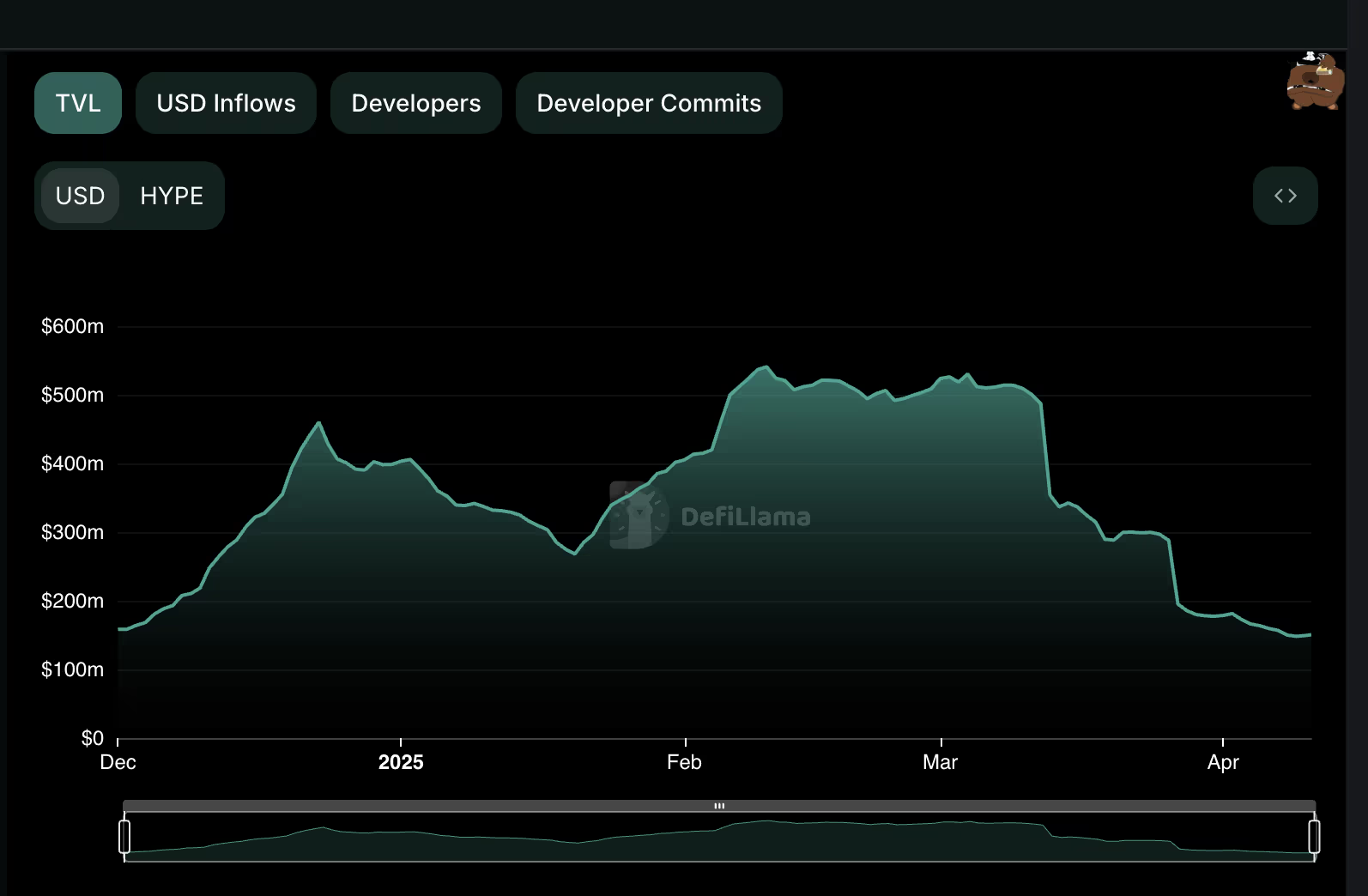

Users have left the DEX and TVL has dropped to $150 million from $540 million over the past month.

Oliver Knight | Edited by Sheldon Reback Updated April 10, 2025, 7:16 PM Published April 10, 2025, 5:00 PM

What you need to know:

- Over the past month, the total value of locked assets in the HyperLiquid vault has decreased from $540 million to $150 million.

- The capital loss is related to the trading situation with the JELLY token, which resulted in the token being delisted and set at a price that helped avoid financial losses for the repository but raised concerns about centralization.

- Experts say the incident was a mistake on HyperLiquid's part.

Just two months ago, the total value locked (TVL) on HyperLiquid, a decentralized derivatives exchange (DEX) that allows traders to earn by placing funds in shared storage, reached a record $540 million.

Now users are leaving the platform, TVL has dropped to $150 million, and yields have dropped to a measly 1%, which in most cases is lower than the interest on bank accounts.

The incident involved one user manipulating the price of a token called JELLY, causing losses for the storage facility known as Hyperliquidity Provider. However, it wasn’t the negative PNL that caused the customers to leave. Rather, it was HyperLiquid’s reaction that raised doubts about the protocol’s true degree of decentralization and its operation as the centralized exchange it sought to distance itself from.

To manipulate, the user shorted JELLY on HyperLiquid, meaning he sold tokens he did not own. He also purchased tokens on low-liquid decentralized exchanges. The lack of liquidity tricked the price oracle into passing on an inflated price to HyperLiquid, causing the HyperLiquid vault to inherit a toxic position via liquidation.

As the price of JELLY rose due to pressure from spot buyers, the PNL for HyperLiquid storage continued to go deeper into the negative. Eventually, the exchange force closed the market for JELLY, setting it at $0.0095 instead of the $0.50 that was being transmitted to oracles via decentralized exchanges.

This meant that the negative PNL was eliminated, and on paper the vault looked good throughout the entire situation. However, the move raised concerns about the control of what was supposed to be a decentralized process. At the time, Newfound Research CEO Corey Hoffstein expressed doubts about the legality of HyperLiquid’s actions, and social media was engulfed in outrage.

Some believe the incident was a mistake on HyperLiquid's part.

“The Jelly exploit on Hyperliquid was not an accident,” Jan Philipp Fritsche, managing director at Oak Security, told CoinDesk. “It was a classic case of undervalued Vega risk: allowing leveraged trading on volatile assets without properly considering how that volatility could deplete the risk fund. The attacker took huge contrarian positions in JELLY, knowing that one side would collapse and the other would profit.

“This is not a theory. It happened. And it will happen again. We have already noted this risk vector during the audit, but economic deficiencies are often ignored because they are not technical. This is a mistake,” Fritsche added.

In this case, the manipulator suffered minor losses.

It should be noted that HyperLiquid has attempted to address

Источник