Bitcoin Price Drops to $80K, Hashrate Soars to Record Highs

The price of Bitcoin has fallen significantly, falling from an all-time high of $109,000 to $80,000 on April 10, 2025. The cryptocurrency's network hashrate and mining difficulty have reached their all-time highs despite the overall market decline.

Bitcoin Drops to $80K, But Hashrate Reaches ATH

“Despite the decline in the price of Bitcoin from $109,000 to around $80,000, the hash rate and mining difficulty continue to reach historical records.” – @Yonsei_dent

Read more ⤵️https://t.co/bI6w3jOs7g pic.twitter.com/rAnPXi8c4Q

— CryptoQuant.com (@cryptoquant_com) April 10, 2025

Falling prices reflect network strength

The price decline that started at $109,000 has left investors questioning the market trends due to the current position around $80,000. Fundamentals provide conflicting information compared to price observations.

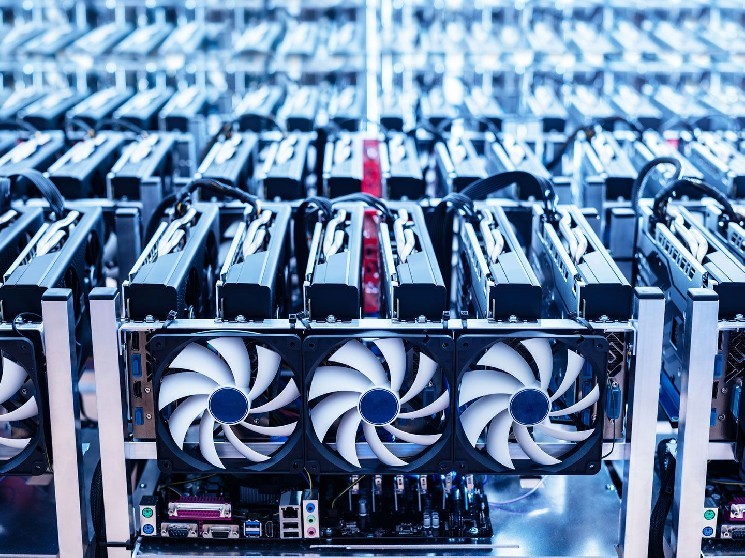

Current network security measures, measured by hashrate, have reached record levels. Mining difficulty, as well as its key metrics, have increased to unprecedented levels during this period. Current mining trends show that miners are devoting more resources to ensuring blockchain security.

Why Complexity Growth Matters

The increase in mining difficulty seems to indicate negative consequences for the average user. Bitcoin mining becomes less profitable as the difficulty increases, as it requires more computing power and energy to perform operations at current prices. Cryptocurrency experts interpret the rising figures as a positive sign for the market.

High hiring rates and mining difficulty show that miners are increasing their technological investments and confidence in innovative mining infrastructure. The fortified Bitcoin network consistently protects itself from hacks, maintaining its market value even with price fluctuations.

A Future with a $5 Trillion Market Cap?

CryptoQuant CEO Ki Young-ju is raising the level of optimism in the market with his recent comments. The current hashrate of the Bitcoin network allows for a market cap of $5 trillion, which is significantly higher than its current value of $1.6 trillion.

Forecasts suggest that the cryptocurrency's price could triple as it matches its operating power. Bitcoin would need its market cap to increase by more than 200% to reach its $5 trillion target, although historical price growth suggests that this goal remains achievable.

What does the future hold for Bitcoin?

Market sentiment around Bitcoin price is out of sync with historical highs in hashrate performance. Short-term price declines are causing panic in the market among traders, while the network’s operational capacity is pointing to steady progress in the long term. Continued mining operations are strengthening Bitcoin’s foundation, indicating a potential price recovery.

Source: cryptonews.net