Ethereum Price Drop Back to $3,000 Likely

The Ethereum (ETH) price is flatlining into the year’s end as traders digest recent price moves and look ahead to what’s to come in 2025.

Last around $3,330, the Ethereum price is set to end December with losses of around 10%, after a more-hawkish-than-expected Fed meeting midway through the month triggered a market wide sell-off.

That said, ETH continues to trade nearly 40% higher versus its levels prior to incoming US President Donald Trump’s early November election victory.

And, while the ETH price has lost momentum in recent weeks and dipped below its 21 and 50DMAs, it continues to find strong support above its 200DMA in the $3,000 area.

Chart analysis suggests near-term downside is a possibility in the coming days, particularly with Bitcoin (BTC) looking vulnerable to a pullback under $90,000.

But the Ethereum price has many important headwinds going into 2025. Here’s why ETH is likely to pick up in price sooner rather than later and fly back to record highs.

Ethereum Price – Strong Comeback in 2025 Likely, Here’s Why

Donald Trump’s decisive election victory in November, coupled with the Republicans winning back majorities in the House and Senate, sets up an exciting year for crypto in 2025.

Trump’s administration is stacked with pro-crypto leaders, from Treasury Secretary to the new SEC chair, to the newly established AI/Crypto Czar position, the regulatory environment in the USA is about to swing decisively pro-crypto.

That might even culminate in the Trump signing off on an order for the USA to start buying BTC for a strategic Bitcoin reserve.

🇺🇸 Schwab says #Bitcoin could hit $500K–$1M when Trump establishes a Strategic Bitcoin Reserve. pic.twitter.com/3cArfgRYTU

— Bitcoin Archive (@BTC_Archive) December 6, 2024

Meanwhile, Congress is likely to pass comprehensive crypto regulation to give the industry the certainty it has long craved.

That’s a 180 degree swivel from the policies of the incumbent Biden administration, who has worked hand in hand with the SEC and other regulators to make life as difficult as possible for the crypto industry since 2022.

Unsurprisingly the outlook for Bitcoin for 2025 is very strong. However, things are potentially even better for major altcoins like the price of Ethereum.

The unfriendly US regulatory regime of recent years has hurt the development and adoption of major web3 industries like DeFi.

So even if Ethereum was able to escape classification by the SEC as an “unregistered security” and secure spot ETFs in the US, its adoption has been hobbled.

But a pro-crypto environment in the should get things moving again, suggesting a great outlook for DeFi/web3 chains like Ethereum.

But what about Ethereum’s competitors stealing its shine? Well, competitors will undoubtedly continue to rise.

But Ethereum remains the daddy in the altcoin space – over 55% of the total USD value of crypto locked in DeFi smart contracts is on Ethereum per DeFi Llama, thanks to it being the most trusted chain.

Moreover, Ethereum has the backing of Wall Street behemoths like BlackRock, who have even launched tokenized investment products on it, plus dozens of other major companies building on it.

Major companies building on Ethereum:

– BlackRock

– Franklin Templeton

– PayPal

– Robinhood

– Visa

– Stripe

– Google

– Venmo

– Sony

– Samsung

– Deutche Bank

– Citi Group

– UBS

– Microsoft

– Christies

– Fox Corporation

– and many more

The ticker is ETH

— sassal.eth/acc 🦇🔊 (@sassal0x) November 22, 2024

Ethereum’s competitors are likely to continue growing, but there is no reason why Ethereum won’t continue to power on too.

So Where Is Ethereum Headed Next?

During past crypto market cycles, when Bitcoin broke out to new all-time highs and entered price discovery, it has taken Ethereum up to two months to follow suit.

Bitcoin entered its latest phase of price discovery one and a half months ago. So history would suggest the Ethereum price could be about to test record highs by mid-January.

That would line up perfectly with Trump’s inauguration, and could mark gains of as much as 50% from current levels.

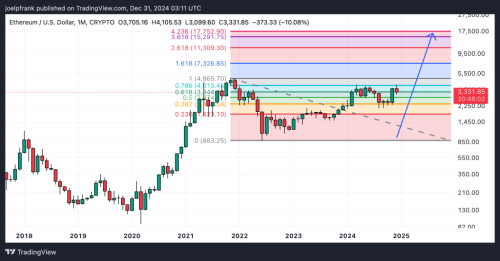

Once ETH breaks into a new phase of price discovery, the sky is the limit. However, Fibonacci extension levels could give some idea as to how high is likely.

For reference, during the 2020 to late 2021 ETH bull market, the Ethereum price rallied to just beyond the 4.236 Fibonacci retracement level beyond its 2017/2018 cycle highs, traced up from its 2020 bear market lows.

If ETH can repeat this feat in 2025, it could hit highs in the $17,700s this cycle. That would mark colossal gains of over 5x from current levels.

Optimistic? Maybe. But either way, the Ethereum price outlook going into 2025 is bright and ETH in the $3,300 is a bargain.

Source: cryptonews.com