Technical analysis in trading

Thanks to technical analysis, it is possible to predict the market. There are two types of technical analysis. Professional is a type of analysis that only experts know. The basic one is the one that ordinary users need.

What is technical analysis ?

Technical analysis in trading is a method of forecasting the movement of the value of the entire market. It is produced on historical indicators. If any asset, commodity or instrument has a history of the exchange rate, you can conduct a study based on it. It is most suitable for short forecasts. Therefore, technical analysis is useful for those traders who are engaged in internal trading.

Also, analysis does not take into account the prospects of the asset. Therefore, for those who are going to invest money for a long time, another type of forecasting is more suitable. For example, funadment analysis. It differs from the technical one primarily in depth. Fundamental analysis is carried out on the basis of documents such as the company’s financial statements.

Main aspects

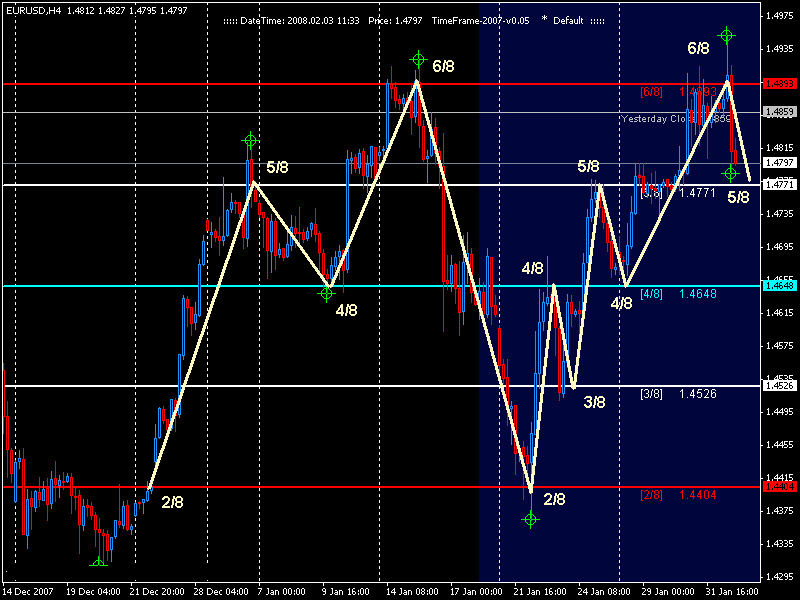

To conduct a technical analysis of the market, you need to know what tools are available to the analyst and how to use them correctly. An important aspect of technical analysis is the statement that there are certain trends in the price movement that can be identified. The main task is to find patterns and predict future changes in value based on them.

Technical analysis contains the basis of data on minimum and maximum prices for a certain period. Thanks to this, it is possible to identify the general trend of the market. Price growth is a bull market. The decline is bearish. There are cases when the price does not change.

Indicators

The most important indicator of technical analysis is a curved line that can be plotted on a price chart based on information about the course movement. To build a moving average, the average value for a certain period of time is taken, because of this, changes in value are smoothed out.

It is also worth mentioning concepts such as convergence and divergence. The first is the phenomenon when the value of an asset falls, while indicators show growth. The reverse situation is called divergence.

Analysis is based solely on historical market data. It does not take into account other factors that may affect the cost. Analysis is more often used to assess the prospects of short positions, and long-term investors resort to fundamental analysis. Since it is more detailed and long.