Terra Luna Classic price forecast after reaching $60 million in trading volume – could LUNC be worth $1 in 2023?

The price of Terra Luna Classic fell 1.5% in the last 24 hours, dropping to $0.00017113. This fall occurred along with the market, which as a whole fell by about 0.5%. The drop is due to the fact that the daily trading volume was just over $60 million, with the altcoin losing 1.5% of its price over the week, but rising 1.5% over the last two.

Nevertheless, the $60 million trading volume is actually down more than 80%, compared to January 14, when the daily volume exceeded $380 million and the LUNC price rose to $0.00019. Thus, it is likely that market interest in the altcoin may be waning, as the Terra Luna Classic team is now rather looking to accelerate the coin’s growth.

Terra Luna Classic price forecast after reaching $60 million in trading volume – could LUNC reach $1 in 2023?

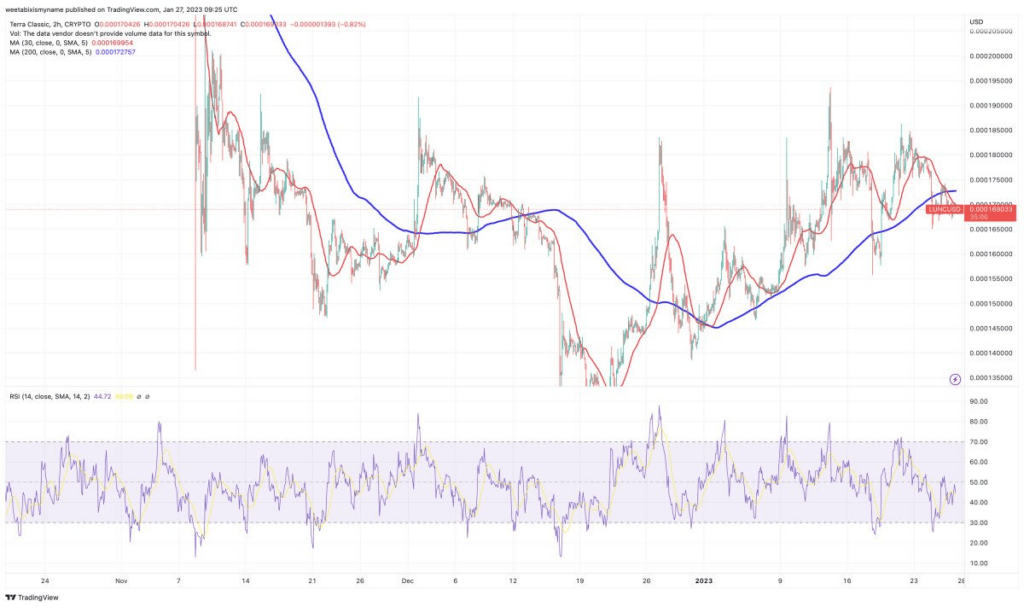

The LUNC price chart confirms the view that the currency is in the midst of a decline that is not yet over. In particular, its 30-day moving average (red chart) continues to be below the 200-day average (blue chart) – meaning that the LUNC price will not rise steadily until the 30-day moving average reaches the bottom.

At the same time, the LUNC Relative Strength Index (purple chart) remains below 50. This is higher compared to the past few days, but it means that the altcoin still lacks the buying momentum it needs to move forward.

At the moment, LUNC is causing a huge debate in the community over the best strategy to promote Terra Luna Classic. Validators and developers initially argued over how much currency to burn and how much to re-circulate, but in the last couple of days a new proposal has emerged: stop paying developer Jacob Gadikian, apparently for his “slandering and attacking validators on the Luna Classic blockchain.”

Needless to say, this is not a good sign. It raises the suspicion that the Terra Luna Classic organization may not be cohesive enough to adopt a decisive plan to restore the LUNC price. Such suspicions could potentially deter other developers from participating in the network because of risk and operational problems.

Nevertheless, there have been positive changes in the Terra Luna Classic space in recent days and weeks. This gives hope that there is still an opportunity to effectively raise prices for LUNC.

Most recently, a proposal was passed to update the Terra Luna Classic blockchain to add whitelisting to its own tax burning on the network. Binance requested such a procedure in order to be able to resume normal trade commission burning (which has been temporarily discontinued until at least March) rather than burn assets on the intranet.

Thus, the burning of LUNC may resume: about 38 billion LUNC have been burned so far (out of a total stock of 6.87 trillion). This amount will probably start to grow faster soon, especially if other exchanges follow Binance’s example and start burning LUNC themselves.

In the meantime, the Terra Luna Classic team keeps suggesting new ways to increase the number of burns. For example, they have proposed allowing users to burn excess LUNC themselves when withdrawing rewards.

In addition, the team is now looking to make Terra Luna Classic compatible with Cosmos, mostly by updating Terra’s implementation of Tendermint. If that happens, it will help Terra Luna Classic attract more developers, more decentralized apps, and more users, which will drive up LUNC prices.

Given these ongoing actions and the changes made, there is a good chance that LUNC can make significant progress this year. And for many among the owners and developers, the $0.1 price seems like an important goal that many are counting on.