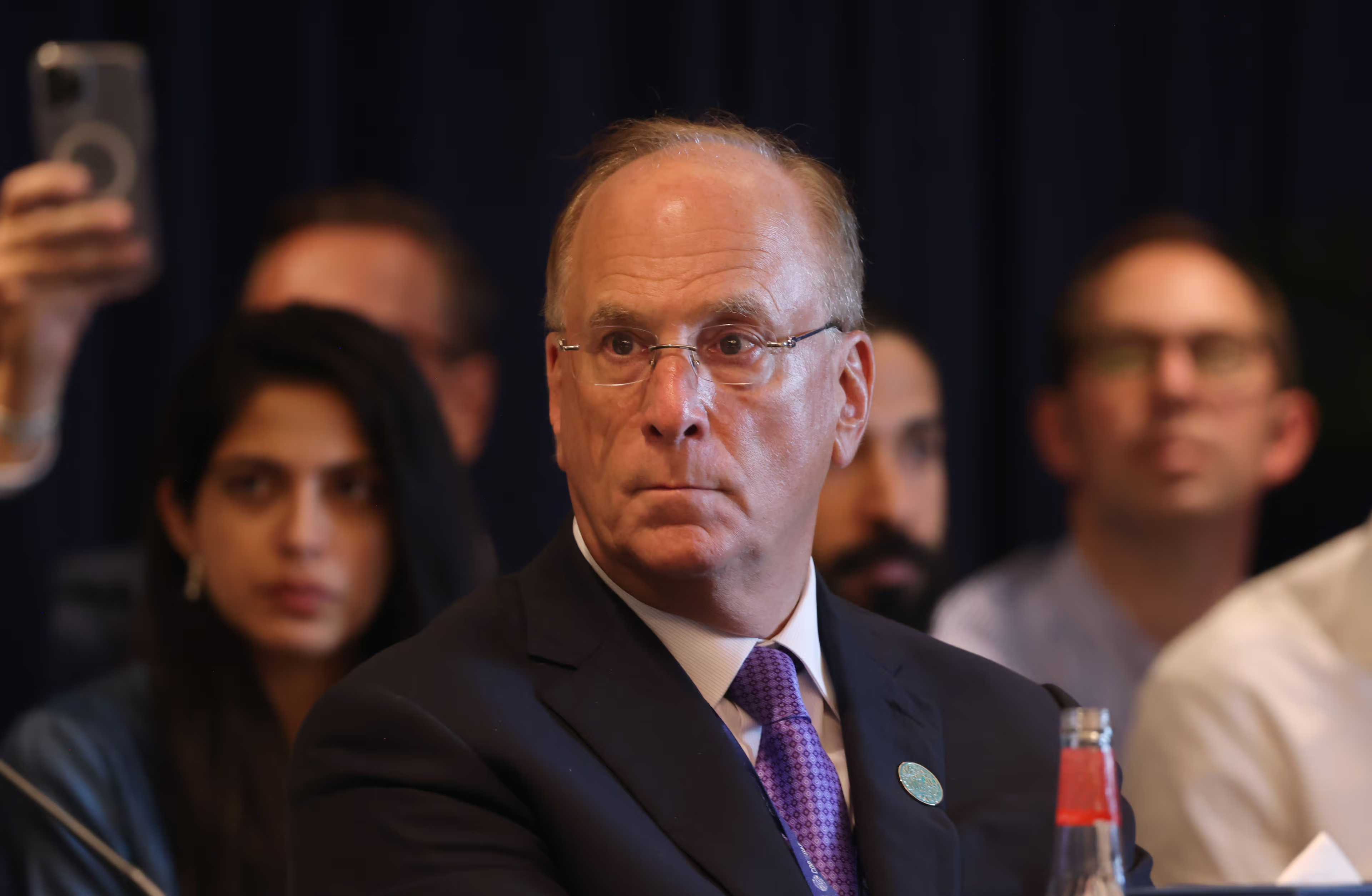

Bitcoin (BTC) Could Threaten the Dollar's Reserve Currency Status, Says BlackRock's Larry Fink

Bitcoin Could Threaten Dollar's Reserve Currency Status: BlackRock's Larry Fink

In a letter to shareholders, the chairman of the world's largest investment firm expressed concerns about the rapid increase in US government debt and the potential competition between bitcoin and the dollar.

Helen Brown | Edited by Stephen Alpher on 31 March 2025, 15:11 UTC

Key points:

- BlackRock CEO Larry Fink has warned that the US could lose its economic advantage over bitcoin unless it gets its national debt under control.

- While supporting decentralized finance and tokenization, Fink emphasized the need to improve digital identity infrastructure to achieve full institutional adoption.

- BlackRock's iShares Bitcoin Trust currently manages nearly $50 billion in assets, and its tokenized BUIDL fund is poised to become the largest in the market.

BlackRock CEO Larry Fink, while remaining a big supporter of digital assets, nonetheless noted that he is not ignoring the potential risks to the United States associated with the growing popularity of Bitcoin (BTC).

“The U.S. has benefited from the dollar being the world’s reserve currency for many years,” Fink said in his annual letter to shareholders. “But there’s no guarantee that will last forever… If the U.S. doesn’t get its debt under control and the deficit continues to grow, America risks losing that position to digital assets like Bitcoin.”

“I’m certainly not against digital assets,” Fink continued. “But two things can be true at the same time: Decentralized finance is a great innovation. It makes markets faster, cheaper, and more transparent. However, that same innovation could undermine America’s economic advantage if investors start to see Bitcoin as a more reliable alternative to the dollar.”

Fink's letter comes amid high market uncertainty and investor concerns about the country's economic situation amid policy changes initiated by U.S. President Donald Trump. To help balance the national deficit, Fink suggested investors diversify their portfolios by adding private market assets to stocks and bonds.

Emphasizing his commitment and belief in digital assets, Fink expressed his belief that tokenized funds will be as popular among investors as exchange-traded funds (ETFs) if the industry can create a more efficient infrastructure for digital identities, which he believes is a barrier to the full adoption of decentralized finance by institutional investors.

“Every stock, every bond, every fund — every asset — could be tokenized. If so, it would revolutionize investing,” he wrote. “If we are truly committed to creating an efficient and accessible financial system, supporting tokenization alone will not be enough. We must also address the issue of digital verification.”

In January 2024, BlackRock became one of the issuers to launch a spot Bitcoin ETF. Their product, the iShares Bitcoin Trust (IBIT), has become the most successful ETF in the history of the asset class. To date, the fund manages approximately $50 billion in assets, half of which comes from retail investors. The fund also introduced a tokenized money market fund, BUIDL, which is expected to surpass $2 billion in assets by April, making it the largest tokenized fund on the market today.