Cango Inc. 50 EH/s Power Play: Will It Be the Next Big Name in Bitcoin Mining?

Cango Inc. has shifted its focus from car trading to Bitcoin mining and is now aiming to reach 50 EH/s by early 2025. With its growing BTC supply, as well as Tencent’s institutional investor backing and ties to Bitmain, could it be the next surprise player in mining?

Diving into Cango

This guest post was taken from Bitcoinminingstock.io, a one-stop resource for anyone interested in Bitcoin mining stocks, education, and industry insights. Originally published on March 25, 2025, by Cindy Feng of Bitcoinminingstock.io.

It’s been a few weeks since our last analysis of lesser-known Bitcoin mining companies. I’ve paused my research for a bit, partly due to the overall downturn in the sector, but also because I’m recovering from a lower back injury (a reminder to listen to your body and not overwork it).

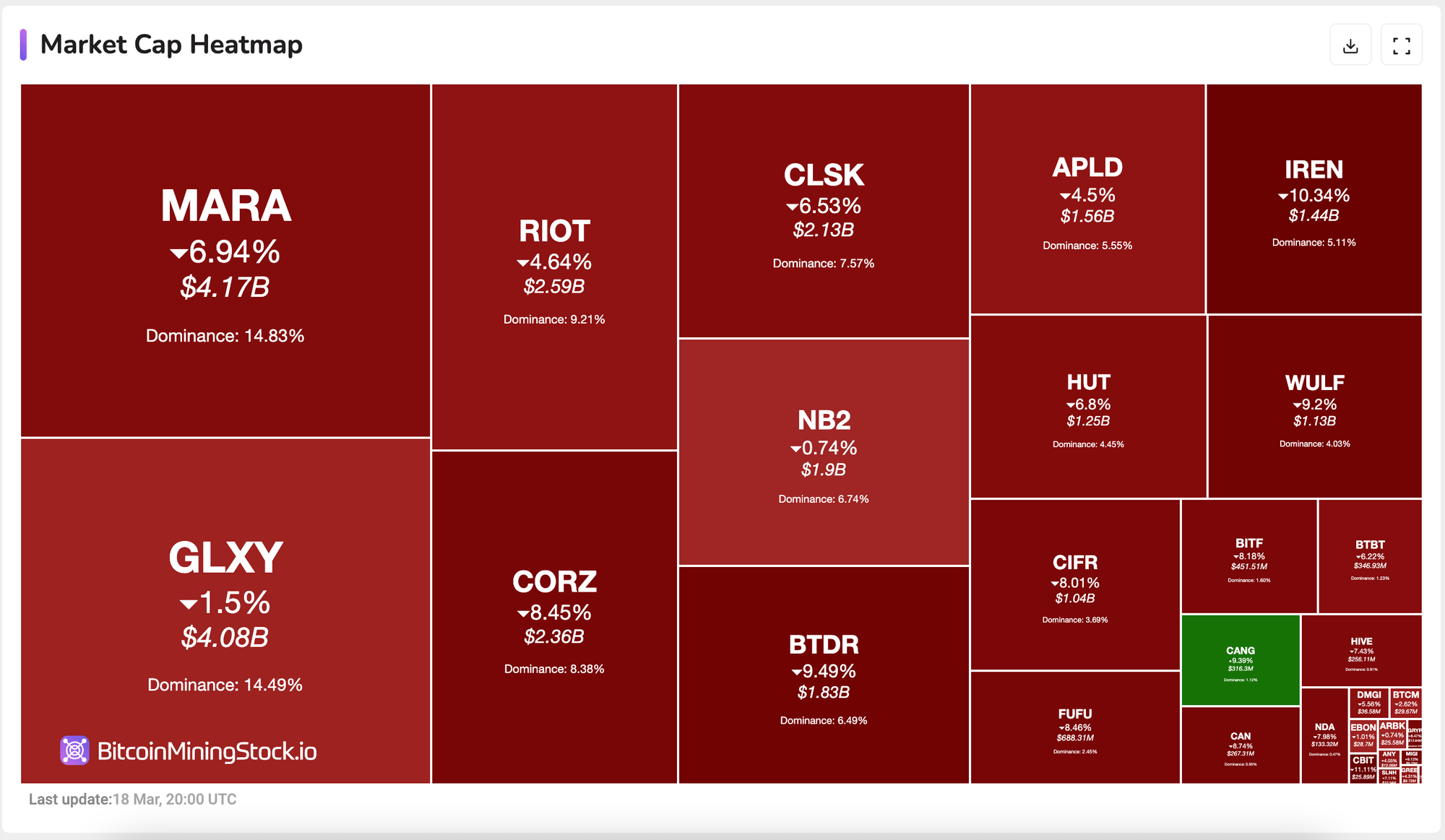

In this second part of the series, I'd like to take a look at Cango Inc. (NYSE: CANG) . Why? While the entire mining sector has been struggling lately, Cango has had some strong days , including a share buyback announcement and a buyback offer .

Bitcoin Miner Stock Heatmap (Real-Time Updates)

Bitcoin Miner Stock Heatmap (Real-Time Updates)

But here's what really caught my attention: Just a few months ago, it was still a car trading platform with limited room for growth. Now it's aiming for 50 EH/s early this year, and 32 EH/s is already in the works .

So how is this bold transition going? And could Cango quietly become a major player in this space? Let's take a closer look.

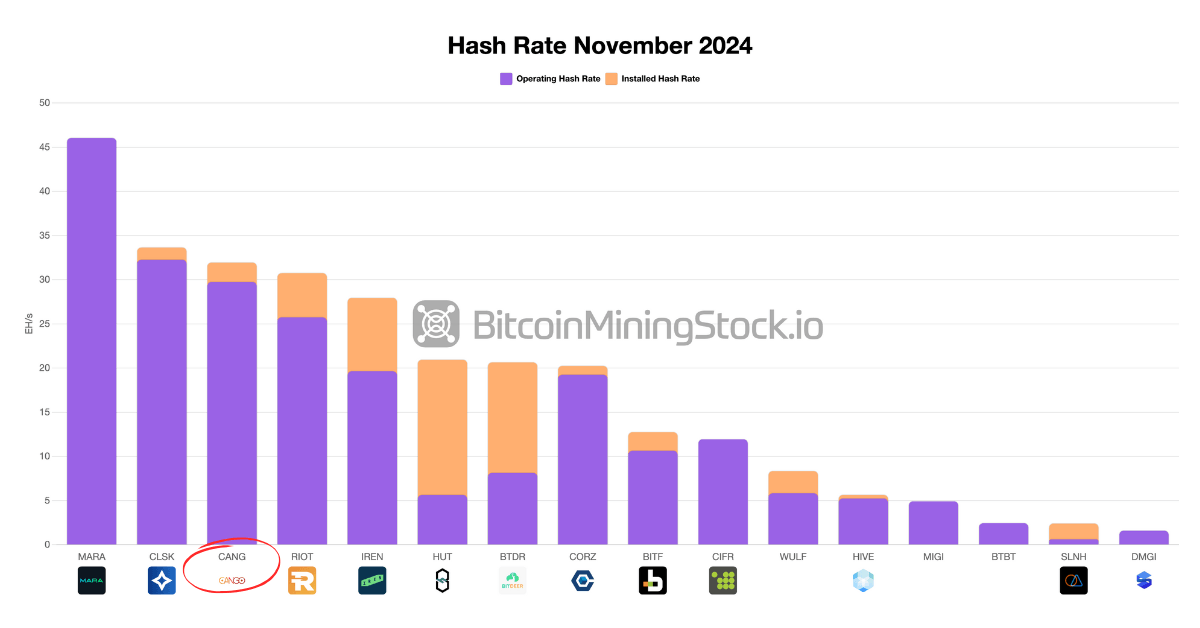

Company information

Cango Inc. (NYSE: CANG) started out as an auto financier in Shanghai and later established itself as a significant player in China’s auto trading market. By late 2023, the company had shifted its focus from the domestic market to facilitating used car sales from China to emerging markets. Then, in November 2024, Cango announced it had entered Bitcoin mining, launching operations with 32 EH/s of online hashrate . The scale and speed of this transition surprised many investors, placing Cango just behind MARA and CleanSpark as the third-largest public Bitcoin miner by installed capacity at the time.

Public Miners Hashrate Review

Public Miners Hashrate Review

The mining hardware acquisition deal was for 50 EH/s in total, with the remaining 18 EH/s to be put into operation in Q1 2025, in accordance with the performance conditions specified in the agreement. Notably, the infrastructure was not built from scratch: Cango purchased the operating ASIC fleets directly from Bitmain , and a Bitmain subsidiary continues to manage the operation and maintenance of these machines in third-party hosting centers.

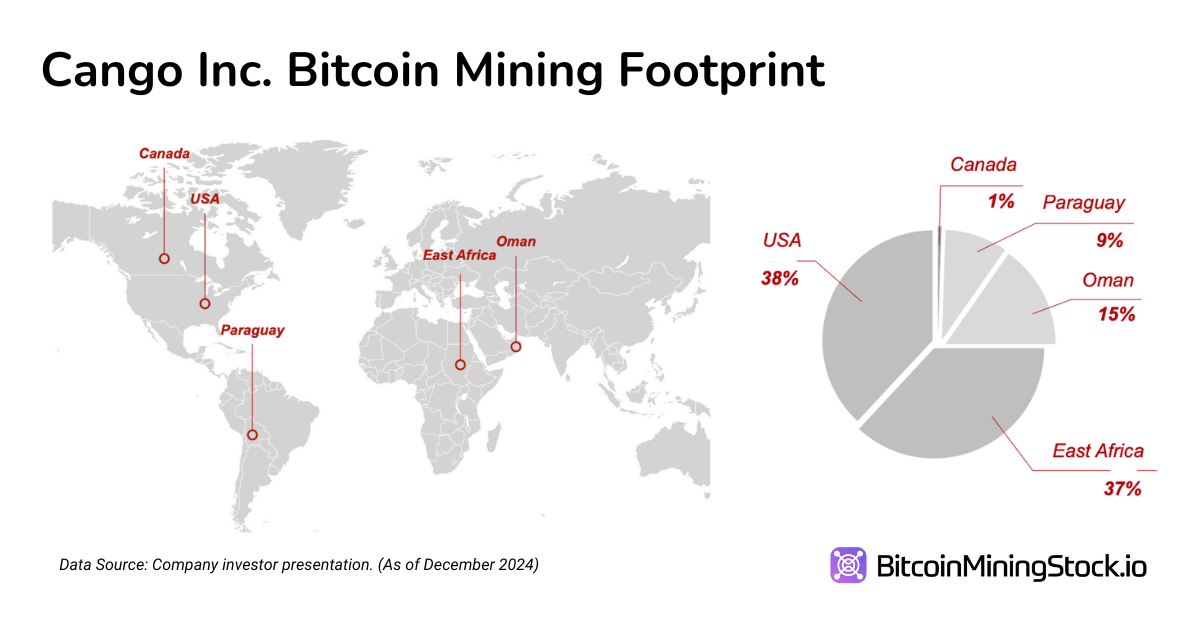

According to the company's disclosure, Cango's fleet is primarily based in the United States, East Africa, Oman, and Paraguay , thereby avoiding China's cryptocurrency restrictions.

Financial results

Changes in revenue and profitability

Cango’s move into Bitcoin mining is clearly reflected in its latest financial results. In the fourth quarter of 2024, the company reported revenue of 668 million yuan ($91.5 million), up 414% year-on-year . That growth was almost entirely driven by Bitcoin mining , which accounted for 98% of total revenue. By contrast, the automotive trading segment, once Cango’s core business, brought in just 15 million yuan ($2.1 million), signaling that this legacy segment is effectively winding down.

Despite revenue growth, profitability remains a key issue . Cango posted a gross margin of 17.6% in Q4, significantly lower than peers with comparable scale of operations. For example, CleanSpark , which operates in a similar hashrate range, posted a gross margin of 57% in the same period. This indicates that Cango’s cost structure is far from optimized. Dependence on third-party hosting and exposure to high electricity costs are two key factors.

The company's average cost of producing Bitcoin was $67,769 per BTC (cash costs include electricity and hosting costs)

Source: cryptonews.net