Foundry, Antpool, and Viabtc Dominate Bitcoin Mining: Here's Why

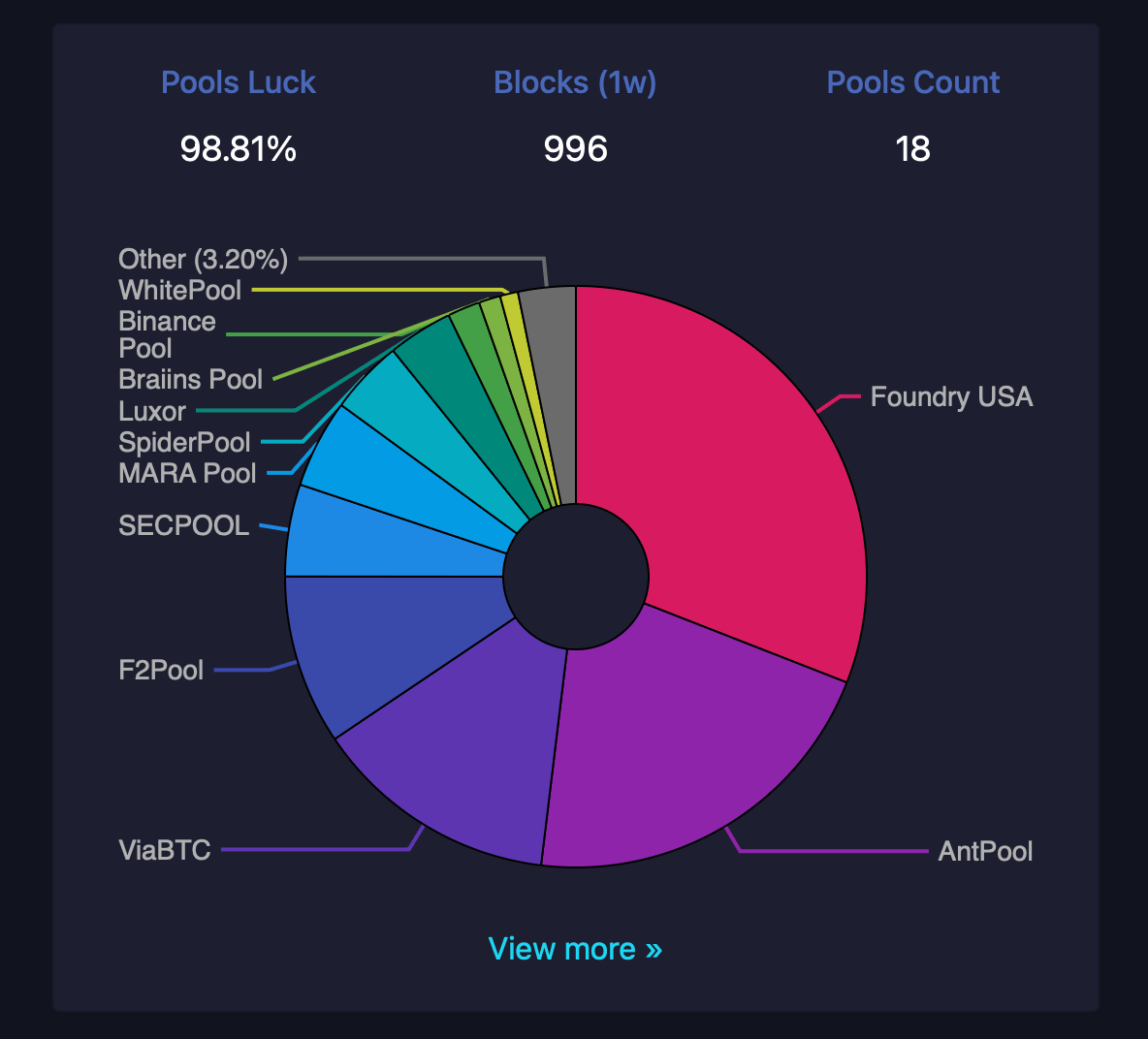

Mining pools Foundry, Antpool, and Viabtc collectively control over 65% of the network's global hashrate, leveraging their dominance through scale, competitive fees, and tailored incentives for participants.

What are mining pools?

Shared mining pools combine the computing power of individual miners to increase the probability of finding blocks, distributing rewards proportionally to the computing power contributed. As of March 20, 2025, the total computing power of the Bitcoin network is 809.65 EH/s. The leaders in this segment are Foundry USA (246 EH/s), Antpool (173 EH/s), and Viabtc (111 EH/s), which together account for approximately 65.5% of the world's computing power, according to mempool.space.

Their extensive infrastructure attracts miners who prefer a stable income, which creates a significant effect whereby dominant pools continue to expand while smaller competitors face increasing pressure.

Foundry USA's Leading Positions

Foundry USA currently holds the top spot, controlling nearly 30% of the total Bitcoin hashrate. The pool’s appeal stems from its stringent security measures, such as KYC/AML compliance, address whitelisting, and SOC 2 certification, as well as its fee-free Full Pay Per Share (FPPS) payout structure, which provides stable returns for institutional participants. Its “Donate” initiative further sets it apart, allowing miners to donate a portion of their revenue to Bitcoin development in order to foster goodwill in the ecosystem.

Foundry’s U.S. operations claim to offer regulatory predictability, an important consideration for miners concerned about geopolitical instability. Publicly traded miners Bitfarms, Hut 8, and Cipher Mining are believed to be working with Foundry’s dedicated pool. Of the last 998 blocks, Foundry has found 310.

Antpool

Antpool, which ranks second with 173 EH/s, leverages its relationship with Bitmain Technologies (founded in 2013) to ensure reliability and trust. The pool uses a fee-free Pay Per Last N Shares (PPLNS) model, optimizing profitability for miners. Its combined mining functionality allows participation in multiple blockchains at once, increasing potential profitability without additional costs.

Antpool's geographically distributed network of nodes, spanning the US, Germany, and China, minimizes downtime, while low payout thresholds and a strong reputation add to its popularity. Bitfufu and Bitdeer are said to contribute hashrate to Antpool's collective computing power. Over the past 998 Bitcoin blocks, Antpool's hashrate has managed to mine 209 blocks.

Viabtc

Viabtc, ranked third with 111 EH/s, focuses on profitability with its unique PPS+ payout system designed to increase miner profits. The platform attracts users with integrated financial tools such as crypto-backed loans and hedging strategies, as well as real-time Telegram notifications on hashrate fluctuations. Viabtc’s flexible payout options make it an attractive choice for miners. The pool offers PPS+, PPLNS, and SOLO payout methods, catering to different miner preferences.

Notably, PPS+ is a unique system of Viabtc designed to maximize profitability, a benefit noted in the Ultramining review. By supporting merged mining of litecoin (LTC) and bitcoin cash (BCH), Viabtc is said to offer several opportunities for diversification. Miners are reportedly flocking to this particular pool due to its intuitive interface, mobile app, and global user base. Of the 998 blocks mined, the Viabtc pool managed to capture 136 of them.

Why Miners Choose Larger Pools

Miners are increasingly turning to large mining pools like Foundry, Antpool, and Viabtc for their reliability and stable reward distribution. These organizations reduce operational risks with advanced infrastructure, dedicated support, and cost-effective fees—benefits that smaller pools struggle to replicate.

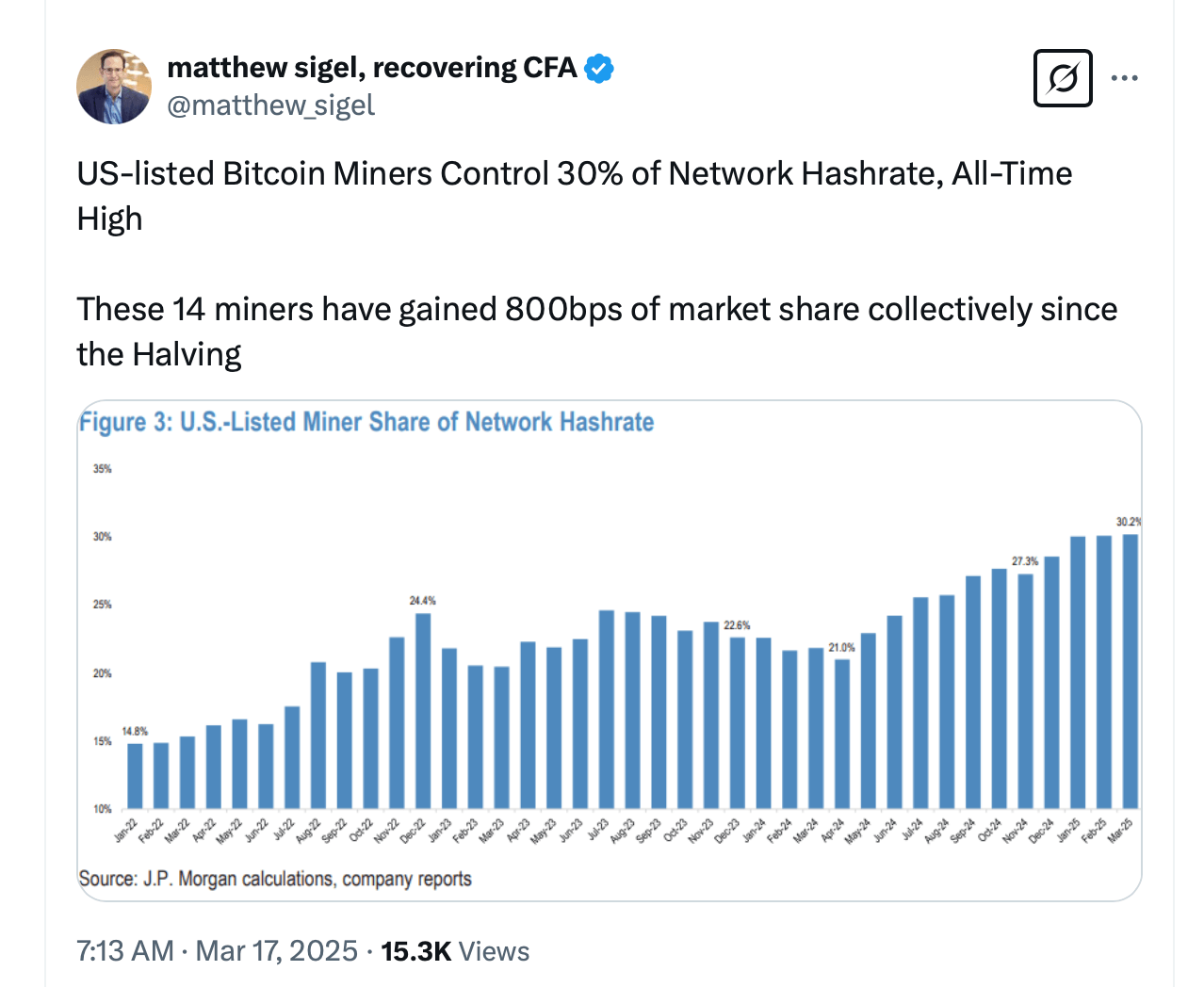

However, the resulting centralization raises debates about the nature of Bitcoin, as concentrated computing power could theoretically expose the network to coordinated vulnerabilities. These debates have been raised many times, but so far nothing has been able to effectively stop the process of centralization. As of March 2025, the trio's 65% hashrate share reflects a continuing trend of increasing centralization unless something changes.

While miners benefit from stability and efficiency, this consolidation challenges Bitcoin’s decentralized ideals. For example, in the future, one can expect that certain entities and transactions may be blocked if centralization continues to increase without weakening. Economic pragmatism continues to favor this trend, suggesting that centralization

Source: cryptonews.net