Turkey Tightens Crypto AML Rules, Mandating User Info for Transactions by 2025

Turkey is set to implement stringent crypto regulations by February 2025 as part of their effort to tighten anti-money laundering (AML) frameworks to align with global standards.

This legislative move, announced in the final week of 2024, is inspired by similar regulatory initiatives in major jurisdictions, particularly the European Union’s Markets in Crypto-Assets (MiCA) framework.

Source: resmigazete.gov.tr

Under the new rule, Turkish crypto service providers will be required to collect identifying information from users who execute transactions worth more than 15,000 Turkish lira (approximately $425).

This measure aims to curb money laundering and terrorist financing through digital assets.

The regulations arrive at a time of heightened scrutiny over the crypto sector, driven by Turkey’s growing prominence in global cryptocurrency markets.

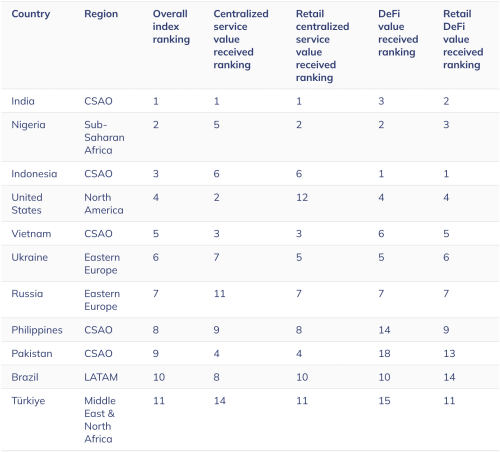

According to Chainalysis, Turkey ranked as the world’s eleventh-largest crypto market by adoption this year.

Source: Chainalysis

Turkish regulators see this as a necessity for comprehensive oversight to prevent abuse within the sector.

New Turkey’s AML Rule Demands User Identity: What Does Mean For Your Crypto Transactions?

From February 25, 2025, all crypto transactions exceeding the 15,000-lira threshold will require Turkish crypto service providers to verify identities.

Additionally, any customer using wallet addresses not previously registered with the provider will need to undergo identity checks.

Providers are authorized to classify the transaction as “risky” and potentially halt it if they cannot obtain sufficient information from the sender.

The bill stipulates that providers may limit transactions or terminate business relationships with non-compliant users in such cases.

This regulatory shift places significant responsibility on crypto exchanges and service providers, requiring them to implement advanced customer verification systems.

To operate legally, firms must obtain licenses from the Capital Markets Board (CMB), which has already received 47 applications since mid-2024 under the new crypto regulatory framework.

Compliance extends beyond user verification, as the Financial Crimes Investigation Board will oversee ongoing operations.

At the same time, the Scientific and Technological Research Council of Turkey (TÜBİTAK) will audit the technological infrastructure deployed by crypto firms.

Although these regulations could enhance consumer protection and fortify Turkey’s financial system against illicit activities, industry experts warn of potential drawbacks.

The rigorous requirements may stifle innovation and deter smaller startups from meeting compliance costs.

Conversely, established international crypto firms may view the regulations as an opportunity to enter the Turkish market.

2025 Global Crypto Regulation Outlook

Turkey’s approach mirrors the European Union’s MiCA framework, which sets a precedent for comprehensive crypto regulation across member states.

However, Turkey’s measures impose stricter conditions on licensing and internal controls.

This contrasts with the fragmented regulatory landscape in the United States, where crypto oversight varies across agencies, leading to inconsistent enforcement.

However, the prohibition of crypto payments—in effect since 2021—remains a notable constraint.

While trading, holding, and investing in crypto are permitted, the inability to use digital assets for direct payments limits their utility within the domestic economy.

To address fiscal challenges, Turkish authorities are also contemplating a 0.03% transaction tax on crypto trades, which could bolster national revenues without significantly impeding market growth.

Turkey is not the only country preparing to implement rigorous regulations for the crypto market by 2025.

According to a recent report, the Central Bank of Russia is developing a centralized surveillance platform to curb illegal financial activities.

🇷🇺 Russia's Central Bank is developing a new surveillance platform to combat illegal crypto OTC services and enhance financial security! #Crypto #Russiahttps://t.co/gSD4mDWDar

— Cryptonews.com (@cryptonews) December 25, 2024

The platform will identify and block “mules”—individuals who use their accounts for illicit transactions, including crypto OTC trades.

This initiative coincides with Russia’s recent ban on mining in 10 regions starting January 2025.

Source: cryptonews.com