Hyperliquid Exchange Faces Liquidation Threat

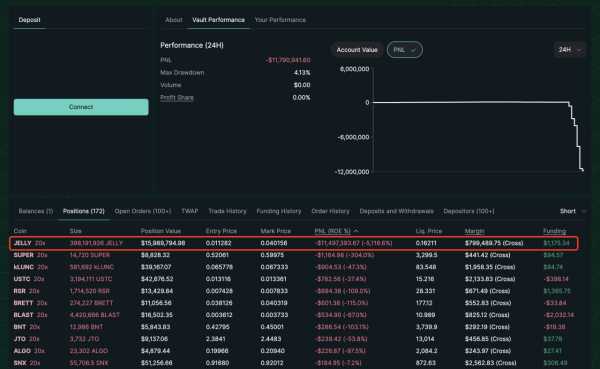

Decentralized crypto derivatives exchange Hyperliquid is facing the threat of closure after a whale manipulated Solana-based memcoin JELLYJELLY. The trader opened a short position with 20x leverage on about 400 million JELLYJELLY, which was 40% of the token's total supply.

Later, he independently liquidated his position by opening a large long, which led to an artificial increase in the price of the asset.

This forced Hyperliquid to automatically buy back his short, leaving the exchange with multi-million dollar losses. The exchange's estimated losses are estimated at $12 million, according to Lookonchain.

Lookonchain also noted that the whale's wallet held 124.6 million JELLYJELLY (equivalent to $4.85 million at the time of the transaction). By crashing the price of the memecoin, he left Hyperliquidity Provider (HLP) with a passive short position of 398 million JELLYJELLY ($15.3 million), and by buying them back, he caused a price pump and losses for the platform.

Following this incident, the community began actively buying up the memecoin, trying to bring Hyperliquid to liquidation.

A crypto analyst using the pseudonym ZachXBT suggested that the funds involved in the manipulations came from the Binance exchange.

At the same time, crypto platforms OKX and Binance announced the launch of futures on JELLYJELLY.

Hyperliquid reaction and consequences

Following the token's listing on OKX and Binance, Hyperliquid closed its short position and ceased trading JELLYJELLY.

Hyper Foundation announced compensation for affected users, excluding suspicious addresses. The exchange's official recorded financial result for the day was 703,000 USDC.

Hyperliquid also removed JELLYJELLY, citing the threat of liquidation and the need to protect the integrity of its network.

However, this decision has drawn criticism from the community. BitMEX co-founder Arthur Hayes stated that Hyperliquid cannot be considered a decentralized exchange.

Impact on the market

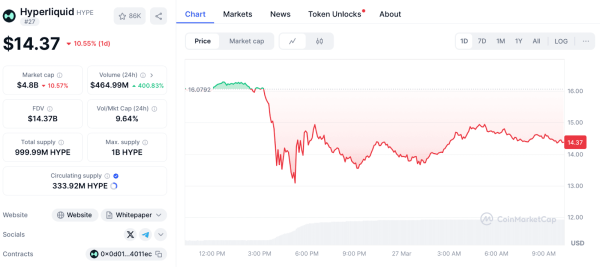

As a result of the situation, HYPE, the native token of Hyperliquid, has suffered a fall – its price has fallen by 10.55% and is at $14.37 at the time of writing.

This situation has raised questions about the risks of centralization and insufficient validators in the Hyperliquid network, which became apparent back in December 2024 when wallets linked to North Korea were allegedly using the platform.

“Like other networks, validators often need to come together to make collective decisions to ensure the integrity of the network. Improving the resilience and transparency of the voting system is a priority,” the service noted.

It should be noted that crypto detective ZachXBT recently managed to establish the identity of the Hyperliquid whale, who earned $20 million in high-risk positions.

Источник: cryptocurrency.tech