Stablecoin Protocol Layer Aims to Expand $80M DeFi Token with New Capital Raising

Stablecoin Protocol Layer Seeks to Boost $80M Yield DeFi Token with New Capital Raise

Since its beta launch, the lvlUSD stablecoin has reached a market cap of $80 million, outpacing rival income-generating stablecoins, the founders told CoinDesk.

Christian Sandor | Edited by Oliver Knight Updated 18 March 2025, 13:21 UTC Published 18 March 2025, 11:22 UTC

What you need to know:

- Stablecoin protocol Level has raised $6 million in total venture funding to develop its yield-generating stablecoin lvlUSD amid growing demand for yield-generating digital assets.

- Level's lvlUSD stablecoin offers investors yield through decentralized finance (DeFi) lending protocols.

- The team plans to connect Morpho to the protocol's yield sources in the coming weeks and expand lvlUSD's functionality beyond staking.

Stablecoin protocol Level has completed a new round of venture funding to develop its $80 million market cap yield stablecoin, as digital asset yield offerings become increasingly popular amid falling crypto prices.

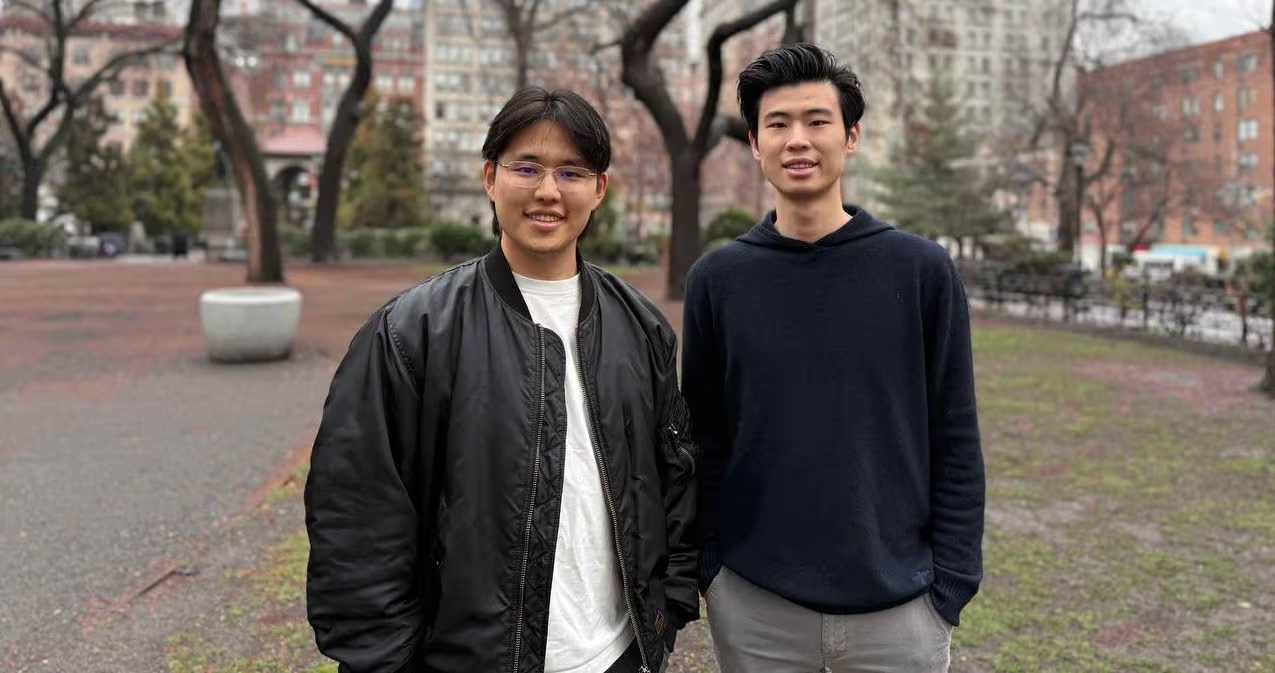

Peregrine Exploration, the developer behind Level, has raised another $2.6 million from early backer Dragonfly Capital, with participation from Polychain, founders David Lee and Qidian Sun told CoinDesk. New investors include Flowdesk, syndicates Echo Native Crypto and Feisty Collective by Path, and angel investors Sam Kazemian of Frax and Albert Chon of Injective.

The latest round follows $3.4 million raised in August, bringing the company's total venture funding to date to $6 million.

Level, with its lvlUSD token, competes in the fast-growing stablecoin asset class, which is one of the hottest sectors in cryptocurrency and attracting the attention of venture capitalists. Stablecoins — cryptocurrencies with a fixed price, mostly pegged to the U.S. dollar — form a key piece of infrastructure for trading and transactions on blockchains. However, leading issuers often fail to provide users with the yields they earn on the assets they hold as collateral. Tether, for example, reported $13 billion in profit last year, thanks in part to the yields on the U.S. Treasuries that back its $143 billion USDT token.

For this reason, a new generation of yield-generating stablecoins is becoming increasingly attractive to crypto investors. Ethena’s USDe, which generates yield based on a market-neutral trading strategy using funding rate futures, has grown its supply to more than $5 billion in just a year. Meanwhile, tokenized versions of money market funds and Treasury bills, another alternative to stablecoins, have reached a market cap of $4.6 billion.

The Level stablecoin offers investors returns from using backing assets in decentralized finance (DeFi) lending protocols like Aave, while automating reserve management. Users can mint lvlUSD by depositing Circle stablecoins USDC or USDT, and lock (stake) the tokens to earn on-chain income, which is generated by issuing USDC and USDT loans. As of last week, the annualized yield for the staking version of lvlUSD was 8.3%, exceeding the yield of the tokenized version.

Источник